Ministry probing price hikes by some city cambios for USD notes

By Stabroek News On October 10, 2019 In Guyana News |

https://www.stabroeknews.com/2...mbios-for-usd-notes/

Winston Jordan

Minister of Finance Winston Jordan yesterday said that an investigation has been launched into why some cambios in the city have significantly increased their selling rates for the United States dollar when there is no shortage in the banking system.

“I can tell you we have adequate reserves. We have almost US$530 million in the banking system. The reserves are nearly US$500 million as at the end of August. The commercial [banks] do have a lot of cash. There is absolutely no question about it,” Jordan told Stabroek News yesterday.

“I haven’t heard a great outcry in the commercial banking system as I am hearing at the commercial non-bank cambios. I am being given to understand that it is at a certain, just one or two of the cambios, that have caused this problem. Our investigation is leading into a certain direction,” he added.

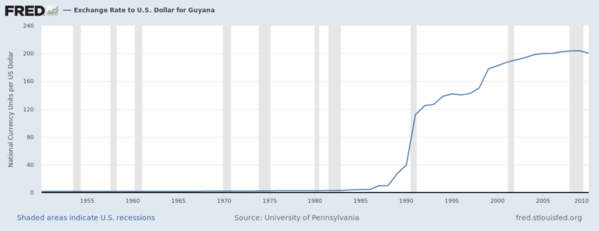

Some popular cambios in the city indicate one buying and selling rate on their notice boards but when a customer attempts to do a transaction, they are told a different rate. At some cambios yesterday, their notice boards stated that the US dollar was being purchased by the cambio for G$213 and was being sold at G$216 but their cashiers informed that the US$20 note was being purchased by the cambio for $215 and was being sold at $220. For the US$50 or US$100 notes, the buying rate remained the same but these notes were being sold by the cambio at a rate of G$225 to US$1.

Checks at Republic Bank and the Guyana Bank for Trade and Industry revealed that US dollars were available for purchase.

Bank of Guyana Governor Gobin Ganga also told Stabroek News that there is enough US dollars at the banks if persons needed to purchase. “There is enough money in the banks [and it can be purchased] at G$215 or G$216 [for US$1]. The rate remains stable,” he said.

“We put in almost US$6 million for the year,” he added, while explaining that it was enough to meet demands.

One banking analyst questioned the need for purchasing at cambios when the banks had the foreign cash easily available for those with legitimate needs. “All who need money for legitimate purposes can go to the bank. It makes you question, why, when people are trading in Guyana, there is need for the US dollar. There is no need for US currency. If rates are going up in the streets and you can go to the banks and buy for $215, why would you go to buy for $235 unless it is for something illegal?”

“Why is there a demand for [US] currency when trade in Guyana is done with the Guyana dollar and if you have a legitimate business you can go to the bank and do wire transfers and so on? You don’t need too much here anyway. For the traveler or someone going on holiday, they can use their debit cards or can also buy from the bank. Questions must be asked why the US [dollar] is so needed, “the analyst added.

The Finance Minister said that he knows of the scheme at the cambios and said that a thorough investigation will be done. He said that he will be able to “make a better report in another week or so to see where this is going.”

But, he said, from the preliminary findings, “we have a very fair idea why there is a shortage of cash and why this is coming from the non-commercial bank cambios.”

Pressed as to what the initial findings were, Jordan said that it was a sensitive matter and he did not want to compromise the investigation.

“I don’t want to because it is a very sensitive matter and we want to make sure the ducks are lined up before we come swinging as they say. But we believe that we are on to something when it comes to there being no cash in certain cambios, particularly the cambio that rushed to increase the rate to [G$]235 to [US$]1,” he said.

“I maintain all the time, nothing differently is happening at this time that has happened two months ago, one month ago or so on. We have an idea and all of the supervisory agencies in terms of cambios will be pooling their resources to go after this issue,” he added.

Jordan also pointed out that while only about two banks have upped their selling rates, the pricing affects “a lot of the cambios” who are competing.

He said that he understands that the foreign currency demand was specifically for large notes such as the US$50 and US$100 and said that it was possibly because “it is easily transportable.”