NIGEL HUGHES IN LEGAL HOT WATER AGAIN

Jeopardises 300 students preparing for CSEC exams in April-May, 2014

THEAlliance For Change (AFC) Chairman, Attorney-at-Law, Mr. Nigel Hughes, seems incapable of staying out of legal trouble. On the 17th January, 2014, Mayfield French, the owner of popular city school Mae’s, sued Nigel Hughes, Hand-in-Hand Mutual Life Insurance Company and the Registrar of the Supreme Court in respect of a property located at Lot 29 Subryanville, Kitty, Georgetown, upon which part of the school has been built.

In the court papers which were seen by this newspaper, French is contending that since February 24th 2006, she purchased the said property from Nigel Hughes for the sum of $20,000,000 (twenty million dollars). She paid $8,000,000 (eight million dollars) as a deposit and went in possession; transport was supposed to be passed within 8 months and a mortgage on the said property was supposed to be paid off before the passing of the said transport.

In the meanwhile, this property was built up by French with buildings constructed on it as part of the school building complex.

According to French, she spent nearly$400,000,000 (four hundred million dollars) on the said property. The portion which was bought from Hughes houses classrooms of Mae’s Secondary School, the canteen and the auditorium offices, washroom and other administrative and learning spaces. However, Hughes never passed transport to her.

STUDENTS’ EVICTION

Before the sale to French, Hughes had mortgaged the very property to Hand-in-Hand Mutual Life Insurance Company. French claimed that it was only in December, 2013 that she first learnt that Hughes never paid off a loan for which this said property was mortgaged as collateral and that Hand-in-Hand Mutual Life Insurance obtained foreclosure proceedings against the property and Hughes since 20th March, 2012. Hughes’s indebtedness to the company stands at over $26,000,000 (twenty-six million dollars). The property was levied upon in December, 2013, by the Marshal of the Supreme Court and purportedly sold at an auction.

According to French, Hughes never disclosed that he did not pay off the loan; that he was sued as a result, and that a foreclosure order was obtained against the property. French claimed as a result she now faces ruin.

In the Court’s document, she states:

“The Plaintiff has no premises in which to house Mae’s Secondary except the building on East ½ of Lot 29 Third Avenue which was built by the Plaintiff specifically for that purpose.

There are three hundred (300) secondary students in occupation of the building, all students of forms 1-5, fifty-nine of which are preparing for their CSEC examination in April and May. These students would face irreparable damage if evicted from their school.”

RANK FRAUD

A senior Legal Practitioner who spoke with Chronicle said Hughes’s conduct constitutes “a rank fraud” against French. “This is the kind of conduct that brings shame and disgrace to the profession,” the source concluded.

Only recently the National Assembly unanimously passed an amendment to the Deeds Registry Act to protect purchasers from the fraudulent conduct of vendors who sell their property multiple times without passing transport or just as Hughes did, mortgage same to a financial institution and then refuse to pay the mortgage.

The Alliance For Change supported this Bill. Little did they know that their own Chairman was himself a miscreant, or did they know?

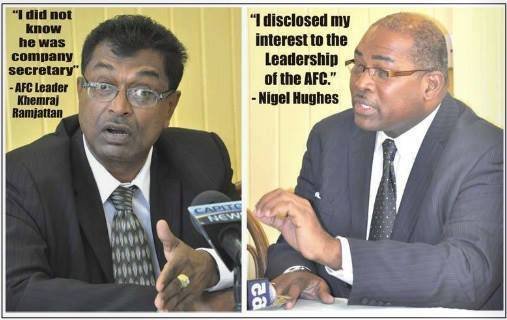

One would recall that Khemraj Ramjattan, leader of theAlliance for Change claimed that he did not know that Hughes was the Company Secretary for Amaila Falls Hydro Inc.

Chairman of the Alliance for Change (AFC), Nigel Hughes, was appointed as the ‘Secretary’ of the Amaila Falls Hydro Inc., the Special Purpose Vehicle/Company created for the development, construction and operation of the US$858M Hydro Power plant.

Chairman of the Alliance for Change (AFC), Nigel Hughes, was appointed as the ‘Secretary’ of the Amaila Falls Hydro Inc., the Special Purpose Vehicle/Company created for the development, construction and operation of the US$858M Hydro Power plant.