Ashni Singh

December 17 ,2021

-will enable withdrawal of entire deposit in first year

After more than sixteen months in office, the PPP/C government yesterday tabled its first oil and gas legislation which will permit, if passed, the withdrawal of the entire amount attributable to the Natural Resource Fund in the first fiscal year and be governed by a Board of Directors (BoD) which it appears will be handpicked by the administration.

The proposed BoD will raise immediate questions about control of key policy matters being exclusively in the purview of the PPP/C administration and its allies in the private sector and elsewhere. This is even though the PPP/C has said it was seeking to lessen government influence on the fund. The PPP/C government has also said it would be spending prudently but the bill allows the withdrawal of the entire amount in the first fiscal year – around US$611m.

“There shall be a Board of Directors of the Fund which shall comprise of not less than three and not more than five members who shall be appointed by the President, one of whom shall be appointed Chairperson by the President,” the Natural Resource Bill, 20 of 2021 states.

“There shall be a Board of Directors of the Fund which shall comprise of not less than three and not more than five members who shall be appointed by the President, one of whom shall be appointed Chairperson by the President,” the Natural Resource Bill, 20 of 2021 states.

It was tabled in name of Senior Minister in the Office of the President with Responsibility for Finance, Dr Ashni Singh.

The Bill gives no explanation on the process for the selection of BoD, except that one person will be nominated by the National Assembly where the PPP/C has a majority. It did, however, say that those chosen will “have wide experience and ability in legal, financial, business, or administrative matters.”

While one person will be a representative of the private sector, no explanation is given on how that person is chosen, such as the private sector providing a list of nominees or selecting a person for the President’s consent.

However, eligibility is set out and persons who are members of parliament, a member of the public Accountability and Oversight Committee established Under Section 6, is a member of the Investment Committee or is or has been declared bankrupt are barred from selection.

Persons medically unfit for office or those with prior convictions of any major offence also cannot be on the Board.

Another eligibility factor states that a person cannot become, or continue as a Director on the Board, if there is “due to personal or family interests and investments, a conflict of interest.”

The Directors of the Fund will be appointed for a period of not more than two years but they can be reappointed when that time elapses.

The Board of Directors would replace the 22-member Committee in the APNU+AFC NRF which was assented to by former President David Granger. The Natural Resource Fund (NRF) Bill, No. 14 of 2018, was tabled in Parliament on November 15, 2018. In the political limbo following the successful December 21, 2018 no-confidence vote against the former government, the controversial bill was passed without the opposition side of the House being present. It was subsequently assented to by Granger in January of 2019.

While the PPP/C had objected to the passage of the bill, the APNU+AFC government went ahead with the process to nominate committee members for the management of the Fund and had invited the then opposition to participate. The PPP/C did not participate and this prevented the activation of key sections of the Act.

On taking office last year, the PPP/C repeated its position, saying the bill would be either amended or repealed. It has since opted for the latter move which will resulted in sweeping changes including the Board of Directors.

The directors will be responsible for “overall management of the fund, reviewing and approving the policies of the fund, monitoring the performance of the fund; ensuring compliance with the approved policies of the fund; exercising general oversight of all aspects of the operations of the fund and ensuring that the fund is managed in compliance with this Act and all other applicable laws,” the Bill states.

Investment mandate

Other responsibilities stated that the BoD of NRF shall “be responsible for preparing the investment mandate” and include the items specified such as “directions relating to the management of credit, liquidity, operational, currency, market and other financial risks; directions regarding ethical investments, including policies standards and procedures for avoiding prejudice to Guyana’s reputation as a responsible member of the world community.”

They will also guide on the percentage of the fund that shall be invested in an eligible asset class and have responsibility for “relevant indices for investments in bills and eligible commodities; the relevant index or indices for investments in eligible equities” from those indices listed under passive investment management.

Noted too is that the Board’s responsibilities also include planning directions in relation to how frequently the Fund shall be balanced and assessing the maximum acceptable tracking error between the relevant index and the relevant eligible asset class.

The Minister of Finance can also delegate duties to the Board within the realms of the Act as it states that a part of their responsibilities would be “such other direction, not inconsistent with this Act, as the Minister deems fit.”

And as they execute their duties, the Board has to “report to the Minister and shall provide such information and reports as the Minister may require.”

When the Board prepares or amends the Investment Mandate, it is to “seek the advice of the Investment Committee,” a group that will be formed to guide the maximising of returns on oil monies earned for Guyana.

The Bank of Guyana shall be responsible for the operational management of the Fund, in accordance with the investment mandate and the operational agreement but a seven-person Investment Committee will be advising the Board of Directors on areas of investments.

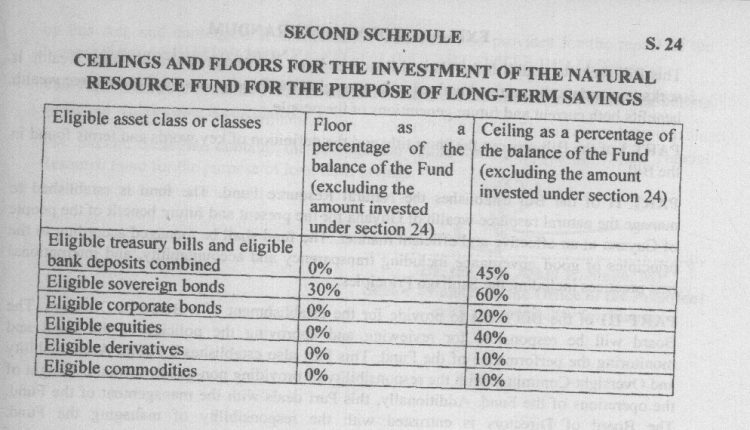

The Bill gives guidance on ceilings and floors for the investment of the Fund for the purpose of long-term savings in the Second Schedule.

The Board of Directors, however, must and subject to the approval of the Minister of Finance and approved by Cabinet, appoint a Senior Investment Adviser and Analyst. That person, the Bill states, will be recruited through an open and competitive recruitment process where anyone from around the globe can apply.

While it is not necessary, the Board could also, again subject to the Minister of Finance’s approval, procure the services of an Investment Advisory Services company.

Public Accountability and Oversight Committee

Providing non-governmental oversight of the Fund will be a nine-member Public Accountability and Oversight Committee which will be appointed for not more than two years, with the possibility for reappointment.

That group will receive quarterly reports from the Board of Directors on the operations of the Fund and is expected to meet no less than once every quarter with the Board to be briefed on the operations of the Fund.

The Committee has a duty to prepare and submit to the Speaker of the National Assembly an annual report on the discharge of its functions no later than the 30th of April of the following year under which it had oversight.

Eligibility for a position on that committee is similar to those of the Board of Directors but included is that the person cannot be an employee of the Ministry of Finance or an employee or owner of an organisation engaged by the Minister or Governor to assist with management of the Bank.

Spending

Deposits in the fund do not change from the criteria set out in the 2019 Bill and which is the system currently being utilised, but noted is that bonus monies are not to be separated. That is, petroleum revenues include all revenue from royalties, profit oil, profit gas, signing bonuses, discovery bonuses, any petroleum income tax, and any other current or future fiscal instrument levied solely or mainly on companies or individuals in production operations, among others.

Rules for withdrawing from the fund have changed significantly but are clear on specific amounts, as the bill says that the Act to be repealed was flooded with technical accounting jargon which leaves the amounts that could have been spent subject to the Minister of Finance as he would have determined how much the “fiscally sustainable amount” would be.

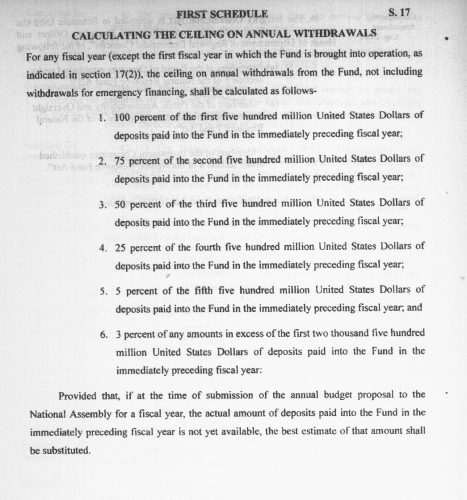

The current bill sets out withdrawal in tranches calculated on percentage from the totals in the Fund at the time.

If this law is passed, it paves the way for all monies accrued to the date of signing in the fund to be withdrawn for spending in the first instance. That sum is currently at US$534 million with an expected approximate US$77 million to be added sometime soon from this year’s final one-million-barrel lift.

“In the fiscal year that this Act comes into operation, notwithstanding the provisions of subsection (1) and of the First Schedule, the ceiling on the amount that may be withdrawn shall be the total balance accumulated in the account …as at the date the Act comes into operation.”

The First Schedule sets out the ceiling on annual withdrawals.

The Bill makes it clear that if at the time of submission of the annual budget proposal to the National Assembly for a fiscal year the actual amount of deposits paid into the Fund in the immediately preceding fiscal year is not yet available, the best estimate of that amount will be substituted.