Berbice River tolls can be substantially reduced

Introduction

The Demerara Harbour Bridge is vested in and operated by a public corporation, while the Berbice Bridge was built and is operated by the Berbice Bridge Company Inc, a private company under a Build, Operate and Transfer Agreement. The Demerara Bridge was constructed under the Burnham administration in 1978 and vested in a public corporation in 2003. The toll for a motor car to cross the Berbice River is $2,200. The toll to cross the Demerara River is $100. There does seems something quite inequitable in such an arrangement and one wonders why a government that draws so much of its support from Regions 5 and 6 would subject its residents to the kind of high fares that the private company charges.

By now, everyone is aware that the country has long come out of an IMF arrangement and even if the bridge was constructed when Guyana was under such an arrangement, the Jagdeo administration was still willing to defy the IMF and World Bank to build the ill-fated Skeldon Sugar Factory, and the stadium. And we have been willing to invest in a $3 billion fibre-optic cable, a specialty tourism hospital and a hotel.

Ghost town

Since the bridge opening in late 2008, business in New Amsterdam has fallen off dramatically. Understandably, if not entirely justifiably then, the local business community is attributing many of the problems facing them first to the location of the bridge and second, to the high tolls charged by the Bridge Company. When I met last Thursday with members of the Berbice business community they complained about the refusal of Chairperson of the Bridge Company Ms Geeta Singh-Knight and her directors to give them an audience and to discuss the effect of the company’s high tolls on their businesses. Indeed, they pointed out the irony that businesspersons from Georgetown are now doing better and brisk business in Berbice, to the detriment of the Berbice businesses. According to the persons I met, the effect of siting the bridge at D’Edward has made New Amsterdam into a ghost town at night.

But notwithstanding their arrogance and insensitivity to Berbicians, the directors – all of whom are Georgetown-based – can do nothing about the location of the bridge. That, according to both government critics and observers, was loaded with political considerations. If the bridge was placed further upriver, traffic would have had to pass through unfriendly villages and the town of New Amsterdam which has never had a warm relationship with the PPP/C. And this was before President Jagdeo described its Mayor in language most inappropriate for Business Page.

The government on the other hand argues that politics had nothing to do with it. That it was about cost. That if the bridge was built further upriver, the capital cost on new roads and the likely logjam in New Amsterdam would have been intolerable. In any case those arguments are moot now: the bridge is where it is and there is nothing the directors or anyone else can do about it.

Addressing the high tolls

Ever since October 16, when in the Business Page column I reviewed the Bridge Company’s annual return and the 2010 financial statements, I have been studying how the second issue – the high tolls – can be addressed. I am more than ever convinced that the legal structure, nature of ownership and the financing model are the cause of the high tolls. The 2010 audited financial statements show that the company had assets of $8.9 billion of which only $400 million was put up by equity shareholders with the remaining $8.5 billion coming from high cost, interest bearing debts, namely, 950 million Preference Shares with a return rate of 11% and redeemable at increasing percentages after year fifteen; Subordinated Loan Stock – $1,250,000,000, repayable 2026; Bonds Tranche 1 – $3,050 million at 9% maturing 2013; Bonds Tranche 2 – $2,525 million at 10% maturing 2017 and Loans – $450 million.

The result is that the company has to pay over $800 million annually in interest alone. Because of the business model and financial structure of the Demerara Harbour Bridge Corporation, that corporation has no debt financing and therefore no interest cost. A similar model for the Berbice Bridge would therefore save upward of $800 million which can then be applied to lowering the tolls.

Savings

My recommendation is for the government to buy over the debts paying by way of Treasury Bills at lower rates of interest to reflect the lower risk of government paper compared with private sector loans to a company whose projections had shown it would be a high risk investment. To the question of why the government should assume the debt, the answer is why should Berbicians be subjected to a model that is different and more costly than that in Demerara?

Some even argue that road users pay no toll and it is unfair for those who live in an important region of the country to have to bear costs which others do not have. The government pays for the roads often with borrowed funds so there is nothing unusual or burdensome about the government carrying the cost via the public accounts.

Readers of this column would also be aware that the investors in the company enjoy the widest range of tax concessions paying no corporation tax, income tax and withholding tax while the company enjoys additional exemptions from customs duty, VAT, etc. In public finance, tax concessions are treated as a cost so the government has a saving, albeit a non-cash one.

Legal structure

The other problem lies in the legal structure and the nature of ownership of the Berbice Bridge Company. It is a private limited company incorporated under the Companies Act 1991 and operating under a Concession Agreement for twenty-one years. This means that all the company’s investment in the bridge has to be recovered within that period, for which the clock is already running. In other words, since the right to operate the bridge ends in twenty-one years, the investment must be written off over that period. That gives an amortization charge of roughly $500 million. Again, if we look for a comparison with the Demerara Harbour Bridge we note that in the 2003 Act creating the corporation, the bridge was vested at a nil value. Apparently the Demerara Harbour Bridge Corporation does not file its annual report and accounts in the National Assembly and I am therefore unable to say whether, subsequent to vesting, it revalued the bridge and has been taking depreciation on it.

My recommendation is that after paying the investors, the government should vest the bridge in a new entity, at nil or at a value lower than the cost. This would allow for a substantially reduced depreciation or indeed none at all, with the savings going to the users of the bridge. An alternative suggested by my partner is vesting at full cost but for the government to make an annual grant to the entity equivalent of the depreciation charge. That seems eminently sensible, since commercial entities like the Chronicle and NCN are given annual subventions with much less justification.

Putting aside money

The other point of considerable significance arises out of what I referred to earlier: the duration of the Concession Agreement which incidentally has not been tabled in the National Assembly or ever released to the public. It means that apart from the annual interest, the Berbice Bridge Company would have to repay all borrowings and preference shareholders at agreed times but no later than at the end of the concession period.

What the Bridge Company requires is to set up a sinking fund account into which it places sufficient cash to ensure that it can meet its obligations as the repayment of the borrowings becomes due. For example, in another two years, the company has to find $3,050 billion to pay the investors in the Tranche 1 Bonds, on pain of penalty. The company clearly will not be able to do so (it had practically no cash balance at December 31, 2010), and will have to roll over the debts. Four years later, Tranche 2 of $2,525 million becomes due and it will also not be able to meet those obligations.

As the end of the concession period approaches, the company will find increasing difficulty in persuading anyone to lend it any money, let alone billions of dollars. From the October 16 Business Page, readers would have noted that the government was forced to waive hundreds of millions of dollars on its preference shares, just so that the company could pretend that it was meeting its other obligations. In fact it was only able to do so by the very dubious and possibly illegal waiver by the government.

Would the government have to waive that more than one hundred million due to it every year and would it also waive the redemption of the preference shares which become due in three years after the second tranche bonds? The Berbice Bridge Company seems to be a walking insolvent company and shielding it from that embarrassment is not only financially sensible but will allow any successor operator to charge considerably lower tolls and yet be solvent.

Looming clouds

In its present form the company requires about $1550 million annually to meet its annual operating costs, the interest and dividends payable to investors, and future loan obligations. In 2010, its total income was $1,115 million, a shortfall of $435 million. The company’s only hope for survival is that traffic would increase by an improbable 50%, or that it can increase tolls by that amount. That would surely be unacceptable, even for Berbicians.

Ramon Gaskin had predicted this situation more than five years ago when Winston Brassington was trying to twist the arm of the New Building Society directors to invest $2 billion in the bridge. The directors agreed with his assessment and it was only when Dr Nanda Gopaul became Chairman that the NBS bought over some $1.5 billion dollars in bonds held by the sinking Clico. I do not believe that we have heard the last of that investment.

Conclusion

Despite substantial subsidies, the bridge is uneconomic for the body of investors as a whole, and most especially the government in the form of exempted taxes running into further hundreds of millions of dollars and in waivers of Preference Shares Dividends. The high cost necessitates an unbearable burden on the users of the bridge in the form of tolls.

Even at, or because of the high tolls, the company will continue to have significant shortfalls to cover annual expenditure and current and future debt obligations. In the medium to long term the company would only be able to repay loans by further borrowings and would be insolvent, ie unable to pay its debts at the time of its contractual handover. The cost of the bridge to users and especially Berbicians is both economic and social.

My recommendation for reducing the high debt cost of the Bridge Company is stated above. Additionally, instead of paying NICIL (or one of its satellites) for the $950 million in redeemable shares it holds, these can be converted to ordinary shares which will attract dividends.

Organisationally, I also recommend the establishment of a national Bridges Authority out of the separate entities. This single entity will own and operate all publicly owned bridges in Guyana enjoying the benefits of shared expertise and management.

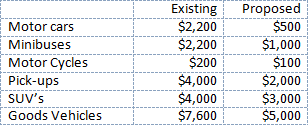

Finally, I recommended in my presentation to the Berbice businesspersons the following toll charges:

My numbers indicate that the new entity will make in one year a surplus of $79 million at the proposed tolls, if the government, having bought out the investors, vests the bridge in the new entity at 50% of its cost. If it is vested at an even lower value the tolls can be reduced even further.