February 1 ,2022

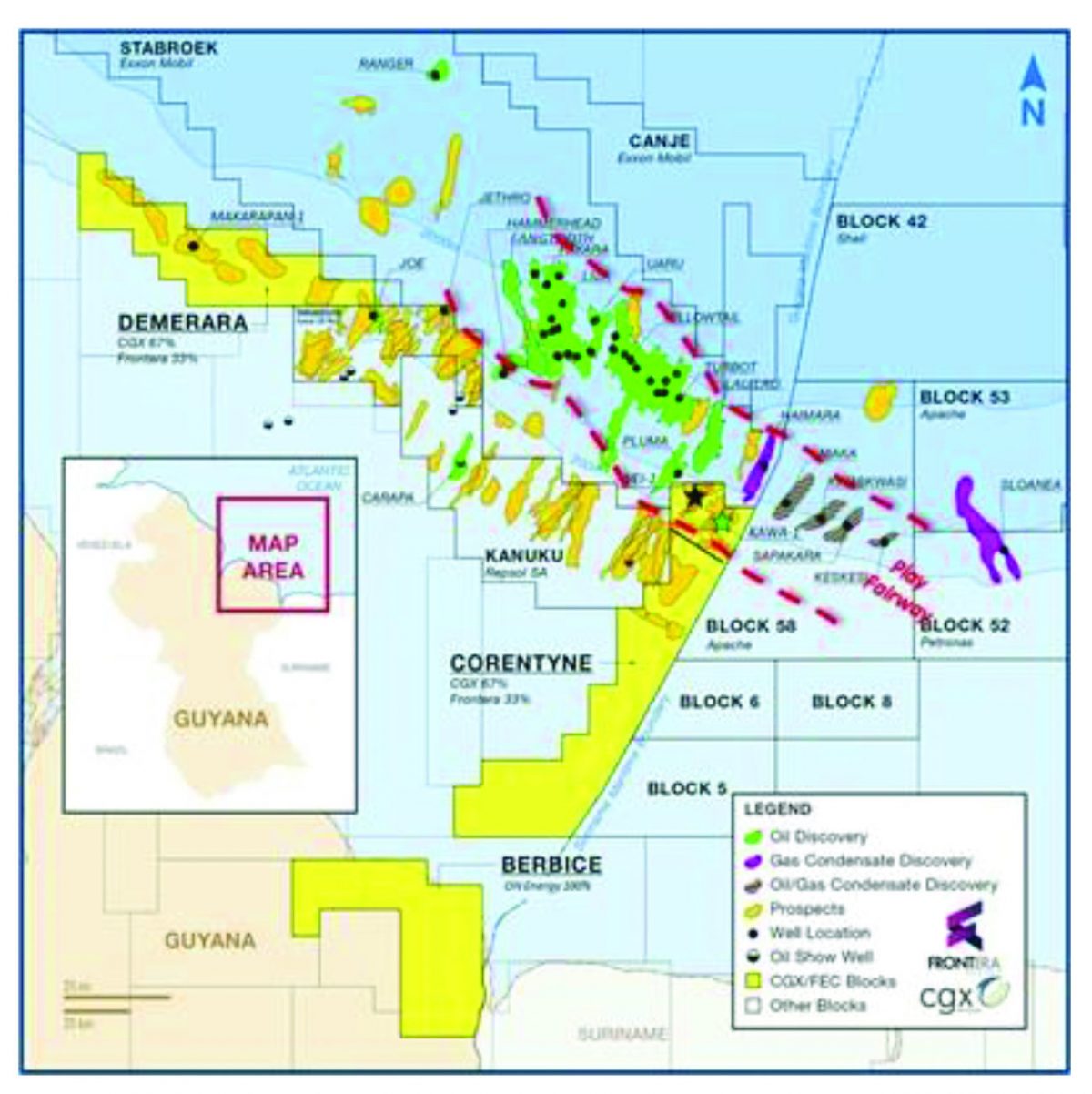

Canadian oil explorers CGX Energy Inc and Frontera Energy Corpora-tion yesterday announced a commercial oil find off the Corentyne coast and this is to be further evaluated.

The declaration of the find would be particularly gratifying for CGX which was formed in 1994 and in 2000 began drilling for oil of the Corentyne until it was chased off by Surinamese gunboats in an action that froze exploration in the area until Guyana won its case before the International Tribunal for the Law of the Sea.

Yesterday’s announcement of the find underlines the riches of the Guyana-Suriname oil basin which has seen both countries notching up huge discoveries. ExxonMobil alone has nearly 30 finds in the Stabroek Block and UK company, Tullow has also discovered hydrocarbons in the Orinduik and Kanuku blocks.

The discovery was made at the Kawa-1 well, in the Corentyne Block, a release from the two Canadian companies said.

Gabriel de Alba, Chair-man of Frontera’s Board of Directors and Co-Chair-man of CGX’s Board of Directors, commented: “Initial results from the Kawa-1 well are positive and reinforce CGX and Frontera’s belief in the potentially transformational opportunity our investments and interests in Guyana present for our companies and the country. Kawa-1 results add to the growing success story unfolding in offshore Guyana as the country emerges as a global oil and gas exploration hotspot. On behalf of the Joint Venture, I’d like to thank the Government of Guyana for its long-standing support as we worked together to deliver this successful outcome.”

The release said that the Kawa-1 well encountered approximately 177 feet (54 metres) of hydrocarbon-bearing reservoirs within Maastrichtian, Campanian and Santonian horizons based on initial evaluation of Logging While Drilling (LWD) data. It said that these intervals are similar in age and can be correlated using regional seismic data to recent successes in Block 58 in Suriname and the Stabroek Block in Guyana. It said that the well also encountered hydrocarbon bearing sands in deeper strata (Coniacian or older) which will also be analyzed and could become the target of future appraisal opportunities. The net pay and fluid properties of the hydrocarbons across the shallow and deep reservoirs will now be determined with electric wireline logging and fluid sampling, “with results to be disclosed as soon as practicable”.

The Kawa-1 well was drilled to a depth of 21,578 feet (6,578 metres) and targeted the easternmost Campanian and Santonian channel/lobe complex on the northern section of the Corentyne block, the release said.

The Kawa-1 results support the Joint Venture’s geological and geophysical models and have helped de-risk similar targets in other parts of the Corentyne licence area. The end of well forecast is currently projected to be the end of February 2022. Information on final well cost estimates and additional results will be revealed upon completion of end of well activities.

CGX said in the release that it is currently assessing several strategic opportunities to obtain additional financing to meet the costs of the longer than expected drilling program.

Professor Suresh Narine, Executive Co-Chairman of CGX’s Board of Directors, commented: “Results from the Kawa-1 well represents a positive milestone in the CGX journey as a pioneer oil and gas explorer in the Guyana Basin. Together with our partner Frontera, CGX looks forward to continuing our socially and environmentally conscious approach to development of Guyana’s oil and gas industry and port infrastructure. We are proud of our long partnership with the Government and People of Guyana and of our reputation as Guyana’s Indigenous Oil Company.”

Orlando Cabrales, Chief Executive Officer of Frontera, commented: “We are very pleased to have successfully drilled the Kawa-1 well with our partner CGX. I commend the significant effort of all the talented employees and contractors involved and their dedication to helping this partnership achieve this important milestone. We now have an ability to focus our efforts on potentially transformational opportunities and to continue our positive relationship with the government and people of Guyana.”

Second Exploration Well to be Drilled on Corentyne

Meanwhile, building on its recent offshore positive results at the Kawa-1 exploration well, the Joint Venture anticipates spudding its second commitment well, called Wei-1, in the northwestern part of the Corentyne block in the second half of this year.

The Joint Venture has exercised its option to use the Maersk Discoverer semi-submersible mobile drilling rig for the Wei-1 well. The release said that this is an important step from a health and safety, efficiency, and operational perspective and will maintain continuity in the exploration programme during a period of high demand in the region and consistency in working with a team familiar with the rig.

“The Wei-1 exploration well will target Campanian and Santonian aged stacked channels in the western fan complex in the northern section of the Corentyne block. The Wei-1 well is named after one of the tallest peaks in the Pakaraima mountain range, which has commanding visibility over the surrounding terrain. Wei Tepu was historically used as a sentinel post by the Patamona People to guard against attacks”, the release added.

CGX is focused on the exploration for oil in the Guyana-Suriname Basin and the development of a deep-water port in Berbice, Guyana.

Frontera is a Canadian public company engaged in the exploration, development, production, transportation, storage and sale of oil and natural gas in South America, including related investments in both upstream and midstream facilities. The release said that Frontera has a diversified portfolio of assets with interests in 34 exploration and production blocks in Colombia, Ecuador and Guyana, and pipeline and port facilities in Colombia. Frontera says it is committed to conducting business safely and in a socially, environmentally and ethically responsible manner.

Over the years, Frontera became the major shareholder in CGX as a result of a series of transactions connected to the financing of CGX’s well exploration programme. CGX had sunk several wells on- and offshore but did not find oil in commercial quantities.

In September last year, Frontera disclosed that it had entered into a term sheet for a US$20 million rights offering bridge loan to enable CGX Energy to continue to fund its share of costs related to the Corentyne, Demerara and Berbice blocks, the Berbice Deepwater Port, and other budgeted costs in Guyana.

It was noted in September last year that CGX and Frontera had agreed that the acquisition cost of any securities acquired by Frontera pursuant to the exercise of rights under the Rights Offering would be satisfied by the reduction of the amounts payable to Frontera under the Rights Offering Bridge Loan. Interest payable on the principal amount outstanding was to accrue at a rate of 9.7% per annum paid monthly in cash, with interest on overdue interest.

A release from the two companies had noted then that CGX, subject to approval of the TSX Venture Exchange, would offer rights to holders of its common shares at the close of business on the record date of October 1, 2021, on the basis of 0.157 of one Right for each CGX Share held. Each whole Right would entitle the holder to subscribe for one CGX Share upon payment of the subscription price of C$1.63.

Frontera disclosed that it has agreed to provide a standby commitment in connection with the Rights Offering.

Up to that point last year, Frontera owned 212,392,155 of CGX Shares, which represented approximately 73.85% of the issued and outstanding CGX Shares. Frontera also had a right to convert certain debt owed by CGX, which if converted would result in the issuance of additional CGX Shares.

As a result of the Rights Offering, Frontera could have increased its ownership of outstanding CGX Shares from its current ownership of approximately 73.85% to approximately 79.11% if no other shareholder participated in the Rights Offering and Frontera elected to exercise its conversion rights under certain debt owed by CGX.

In June 2000, CGX’s rig was chased out of Guyana’s Corentyne waters by Suriname gunboats as it was about to embark on drilling a well in the most promising area. This led to a diplomatic crisis between Guyana and Suriname and years of futile talks. The deadlock was broken when Guyana took its case to the International Law of the Sea tribunal in Hamburg, Germany and secured a ruling largely in its favour in 2007.