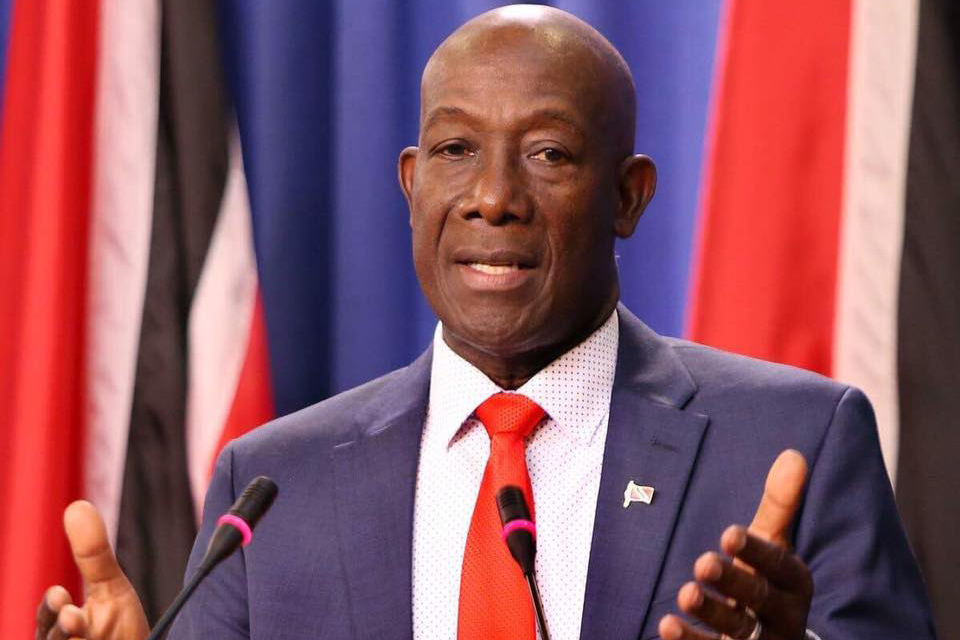

Deodat Indar

September 6,2018

Lamenting the delay in local content legislation that would give businesses here first consideration in providing services and goods for the growing oil and gas industry, the Georgetown Chamber of Commerce and Industry (GCCI) has sent its own draft to the government.

It has also called for a hold to be placed on any Memorandum of Understanding (MoU) with Trinidad and Tobago until it has a clear idea of what it entails.

Both positions enunciated yesterday by the Chamber will be seen as sharp criticisms of the manner in which the government has handled the oil and gas sector.

Speaking at a press conference yesterday at the GCCI’s office on Waterloo Street, GCCI President Deodat Indar said that despite frequent calls for local content legislation since early 2017 when his team took over the helm of the organisation, it has not gained “any kind of response” from the government.

He said while he is happy that there have been numerous national discussions and consultations on the topic, it has not gained any significant traction and delaying its implementation would have adverse effects on the country’s local economy.

“…This morning I dispatched a draft legislation to … President (David Granger),” he said, citing subsection 6(1) of the Chambers of Commerce Act of Guyana which says that the Chamber can initiate, promote or comment on actual, proposed legislative, regulatory or administrative measures affecting trade, manufacture or industry and communicate or to cooperate with the appropriate government institutions to the respect of such measures.

The Chamber president said that with the power vested in them by the Act, they have drafted their own legislation. The draft was also sent to Leader of the Opposition Bharrat Jagdeo, the Ministry of Business and the Ministry of Legal Affairs.

According to Indar, the reason the Chamber took it upon themselves to develop the document is because since 2015 when oil was first found up to now, there has been no policy, law or fiscal rule to indicate that there is a level of legal protection for Guyanese businesses.

He said that the “invisible hand of supply and demand” has been taking its course and foreign companies who have “the inside track and know all of the operators and the subcontractors and have history with them, are accustomed to them, have been getting these contracts for simple things in Guyana.”

“…down to the food that is going for the supply vessels [and] the rigs, come from overseas, down to the water, is fetched from overseas. We know these things and that is why we continue to fight for local content but it seems that they are falling on deaf ears,” he said, while charging that he is going to amplify the fight as long as he is the president of the GCCI.

Indar noted that while the contract between the Government of Guyana and ExxonMobil spells out specifically that Guyanese should be given preference where they can provide goods and services, the definition of Guyanese and Guyanese businesses are too vague and broad.

“One of the things we realised will have to be changed is the definition for what a local company is. Right now the Companies Act, page 334, talks about a resident…but the definition sends you to the Income Tax Act which says a resident in Guyana means the person must be residing for 183 days [in the country],” he said.

Indar explained that in their draft legislation, the definition will be broadened to include more statutory tests of locality such as the requirement of businesses to be registered in Guyana and to have 51% ownership by a Guyanese. The draft legislation also proposes that the head office of the company should be stationed in Guyana and all of its board meetings should be held here. The workforce should also be made up of 70% of Guyanese people in accordance with the Guyana Citizens Act of 1967.

“What this legislation is really saying is that we would like Guyanese people to have first consideration on all goods and services. If you can’t do it, you can go wherever you want. At least give us the fair chance or first consideration,” Indar declared. He stated that he hopes that government listens to the private sector and emphasised that at this point in time, there should be some legislation in place to govern local content and the government should not delay it any longer.

Three and a half years has gone by

“Here is where the issue is: three and a half years has gone by and we don’t have a policy and we don’t have any legislation on local content… I believe it went through several rounds [of consultation] but we need to get this thing finalised and the government should adopt a policy quickly and put a revision date a year from now but at least have something in force to say this is our policy,” Indar declared. He said that if one is not put in place soon, then foreign companies will continue to take the cream of the crop in the oil and gas industry.

Vice President of the GCCI, Nicholas Boyer also made brief remarks and highlighted the importance of there being joint ventures between foreign and local companies so that there can be a transfer of knowledge and skills. This, he said, is a strategy that the Chamber currently uses whenever foreign companies show interest.

He also noted that there should be a clear indication of the reporting mechanism from the operator to explain how much they are purchasing from the local economy so that one would be able to measure how well the country is performing as compared to foreign companies. He said that there should also be training and improvement works through the various organisations to improve the local supplier capacity which will inherently increase how much can be supplied from local businesses to the industry.

Indar also highlighted the recent Memorandum of Understanding (MoU) expected to be signed between Trinidad and Tobago and Guyana, and said he is requesting to see the documents.

“This private sector has not seen any MoU. We don’t know the language and we will be asking for that very shortly. I am using this open forum to ask for that. I am saying that we don’t have a policy or legislation but we are going to do MoUs? I am asking the government to hold on this and let the private sector see the MoU so we know it won’t be adverse to us,” he added.