@Former Member all jokes aside, serious question for you. Need something explained in layman terms cuz I ain't too bright. I read that all the oil revenues are being put into a fund (sovereign wealth kinda thing) and considered "generational wealth". Experts recommend it not be spent.

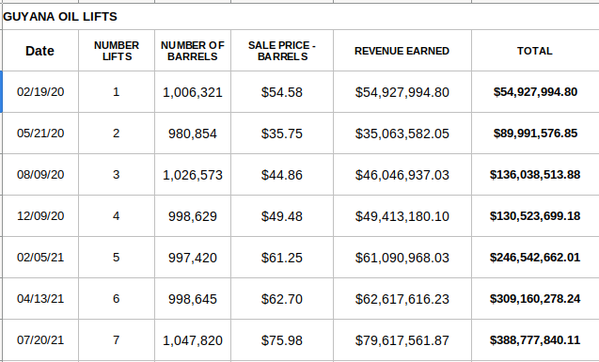

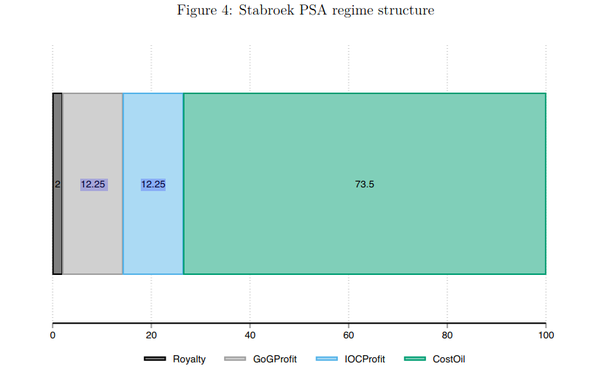

These are oil "revenues". Or is this profit? What about the expenses associated with these oil revenues? How is that accounted for, does it just get chalked up to the national debt?

Assuming these revenues / profits are not being touched, then how are they paying for these generous giveaway programs? Sugar is dead, rice etc. So what's bringing in the revenue to pay for all these "programs" they're talking about. Is this sheer deficit spending or is oil money being used?

Ah gat one mo, but ah kno yuh busy. Tek yuh time, but not too much.