Granger Govt tipped off about Ponzi scheme, but never acted – AG

…ignored warnings, granted citizenship to Cuban at centre of scandal

…new Govt working to recover monies owed to investors

Attorney General Anil Nandlall has revealed that the very company now under investigation for operating a Ponzi scheme in Guyana has been in the crosshairs of authorities for some time, but their warnings to the previous A Partnership for National Unity/Alliance For Change (APNU/AFC) Government went unheeded.

During a press conference on Saturday, Nandlall disclosed that the relevant subject Ministers, particularly former Public Security Minister Khemraj Ramjattan and former Minister of Citizenship Winston Felix, were alerted about the activities of Accelerated Capital.

“Based on the information I received, applications were made to the Bank of Guyana for a license. That was rejected. Applications were made to the Guyana Securities Council for license, that was rejected.”

“And under the previous Government, both the Bank of Guyana and the Guyana Securities Council (GSC) informed the various Ministers of this scheme operating without a license. They received no response,” Nandlall explained.

In fact, Nandlall revealed that the former Government was warned about Yuri Dominguez, the founder of the company, but took no action. The result was that Dominguez was granted his citizenship under the watch of Felix.

“The gentleman is now a naturalised Guyanese. When his naturalisation advertisement was put in the newspaper, the Guyana Security Council wrote to the relevant Minister, Felix and Ramjattan, informing them of the historical antecedents of this gentleman. But those letters received no response.”

According to Nandlall, all indications point to millions of US dollars being involved in the scheme. Despite this, the company has no local bank accounts and authorities are having a hard time tracking down where the monies are.

“The investigations are continuing and I ask the members of the public to please understand that the Government is working to recover your money. That is the Government’s priority. Because from all indications, if this thing was allowed to grow bigger, it would have ensnared more money. And right now, it’s millions of US dollars which cannot be found.”

Closed accounts

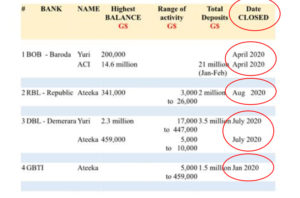

Meanwhile, the Bank of Guyana has revealed that Dominguez and his wife, Ateeka Ishmael, closed all their commercial accounts at various banks in Guyana earlier this year. Bank of Guyana confirmed that as such, they have no current accounts in Guyana.

The Bank released the embattled couple’s financial information in a press statement on Saturday. One account in Dominguez’s name was closed in April 2020. Its highest balance at the time was $200,000. Another account at Baroda in his company’s name was closed in April. Its highest balance was $14.6 million and it had seen a total of $21 million deposits.

Dominguez also held an account at Demerara Bank Limited, where his highest balance was $2.3 million. That account had total deposits of $3.5 million. His wife also had an account with its highest balance at $459,000. Both accounts were closed in July.