Irfaan Ali

May 23 ,2021

President Irfaan Ali yesterday announced that while his government is committed to the transparent spending of Guyana’s oil revenue, it cannot at this stage commit to implementing the internationally praised Norway model for a Sovereign Wealth Fund (SWF).

During the opening session of the inaugural Diaspora Conference, held virtually, Ali along with Vice President Bharrat Jagdeo responded to series of questions from participants.

Asked specifically if the PPP/C government plans to use the Norway model to manage oil revenues both men said that Guyana situation is very different from Norway. “There is a lot of academic debate on different funds and different ways in which Natural Resources Funds are managed globally but what a lot of academic debate don’t tell you is that for example in the Norwegian model it was adopted after the country had a certain level of infrastructure, a certain level of service, a certain level of development,” Ali noted.

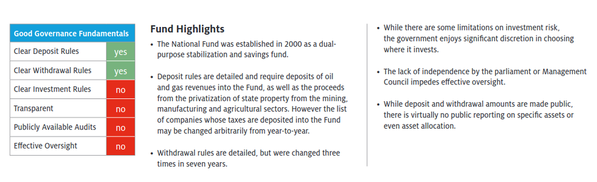

He stressed that in considering the best model to implement, discussions must include the state of the country when a particular model was approved. His government, he noted, is currently examining several models, including the Kazakhstan model.

This model prioritises the dual purposes of economic stabilisation and savings. Notably while the National Bank of Kazakhstan serves as operational manager for the fund, all major strategic and policy decisions regarding the fund are made by the management council, consisting of the President, Prime Minister and high-ranking ministers, government officials and parliamentarians.

While deposit and withdrawal amounts are made public, there is virtually no public reporting on specific assets or asset allocation and the transfer of funds in and out of the National Fund is governed by presidential decrees.

In contrast the Norwegian model, which also performs both budget-stabilisation and saving, is an integrated part of the government’s annual budget with its income providing stable, predictable funding of up to 3% of the fund’s capital in the annual national budget. That means Norway can withdraw as much as 3% of the fund each year.

‘Dire need’

According to Ali, Guyana’s is in dire need of infrastructure transformation, in dire need of transformation in the health sector, in the education sector and in the energy sector. “We have to create the framework for the expansion of these and other important sectors that will bring jobs and create the platform through which our country will evolve into the future, and through which these funds can be modelled, and that is the stage we are in now in Guyana,” he stressed explaining that the drive is to enhance the lives of all Guyanese and give the country the opportunity to become competitive, to access world-class services and world-class infrastructure.

The model adopted will suit these needs, allow for transparency and include input from local sectors, he explained.

“Look at the Petroleum Commission. We are going to establish the involvement of the Parliament and everything we have outlined layers in management of the fund,” he said.

Jagdeo reminded that his party was very critical of the current Natural Resource Fund Act because it did not believe that the model used did not offer enough distance for politicians from its management. “We have always adopted one principal of the Norwegian fund. The fund must be managed in a professional manner distanced from political interference. Second, we are committed to the Santiago principles in terms of transparency in use of the Natural Resources Fund. Thirdly it was the PPP/C government which signed up for the Extractive Industry Transparency Initiative, so we are fully committed to that,” he said, before adding that the PPP/C will also criminalise non-disclosure of receipts from oil companies.

These principles aside, Jagdeo stressed that it would be unconscionable to have children in the present day unable to attend school while the country saves for the future.

). Maybe Guyana should think about paying down its debt and building its infrastructure before sovereign fund. In any case, at the pace it is currently spending there won't be much left to save.

). Maybe Guyana should think about paying down its debt and building its infrastructure before sovereign fund. In any case, at the pace it is currently spending there won't be much left to save.