Guyana’s debt to foreign reserves ratio higher than most countries in hemisphere – IMF

A recent report conducted and released by the International Monetary Fund (IMF) shows that compared with most countries in the Region, Guyana’s external debt to foreign reserves ratio is among the highest.

The IMF report in question is the Regional Economic Outlook of 2019 for the Western Hemisphere. While the report notes that Guyana’s economy will grow when first oil arrives, the country currently does not compare well with others in terms of external debt and its reserves.

Guyana, according to the report, is expected to record a Public Sector gross debt to Gross Domestic Product (GDP) percentage of 55.5 per cent for the year 2019, although the IMF estimates that this will be reduced to 24.6 per cent.

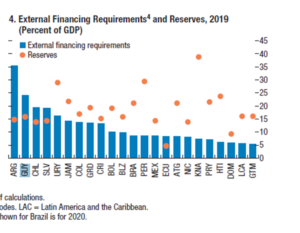

Out of 22 countries examined by the IMF, it found that Guyana had the second highest external financing requirements for public and private. And when compared with Guyana, 17 other countries have more foreign reserves than they do debt.

These 17 countries include Guatemala, Haiti, Peru, Bolivia, Belize, the Dominican Republic, Jamaica, Costa Rica, Antigua and Barbuda, and Brazil. When it comes to debt exceeding reserves, Guyana is in the company of countries like Argentina, Chile, and El Salvador.

Since the previous Administration, the People’s Progressive Party/Civic left office, it has increased by 62 per cent.

In providing advice for countries to manage their fiscal affairs, the report states that “given the challenging global environment and still negative output gaps in the Region, policies will need to strike a balance between supporting growth and rebuilding policy space”.

“Fiscal consolidation to lower public debt remains a priority in several countries. Monetary policy can continue to support growth given the stable inflation outlook and well-anchored expectations.”

The report also notes that global dynamics remain an impediment for economic prospects in the Region. It pointed to sluggish global growth, volatile access to capital and reduced prices for commodities – something Guyana is all too familiar with, when it comes to sugar.

It, therefore, advised countries in the hemisphere to rely on domestic growth to accelerate recovery. Such a recovery, according to the report, will depend on increased private consumption and investments that indicate confidence in the economy.

In its Article IV consultations in Guyana earlier this year and subsequent report, the IMF had found that Guyana’s foreign reserves were inadequate to cover the recommended three months of imports.

According to the report, Guyana has projected 2019 official reserves of US$643 million, with this figure projected to rise to US$857.8 million by 2020. In terms of 2018, the figure was US$528.4 million.