“Where is the good life?”

March 1, 20174

Share on Facebook Tweet on Twitter

VAT on services

– concerned citizens stage protests at Finance Ministry, GRA

Activists, politicians, parents and students on Tuesday simultaneously picketed the Finance Ministry and the Guyana Revenue Authority (GRA).

Their grievances included the imposition of 14 per cent Value Added Tax (VAT) on utility services such as water, electricity and private health care, as well as private education.

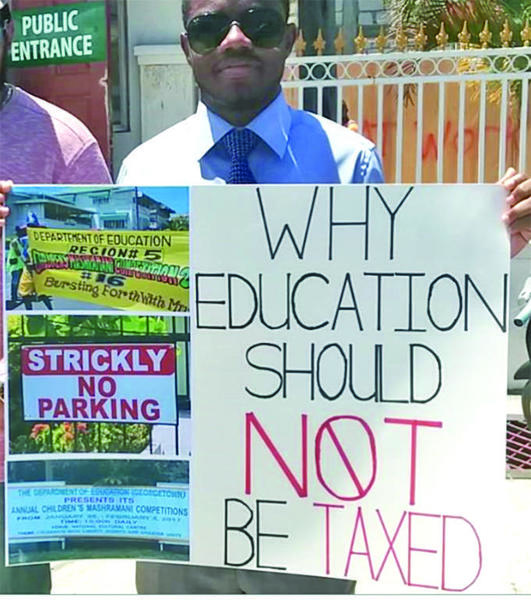

A protester outside GRA holds a placard highlighting several grammatical errors which have appeared on Finance and Education Ministries’ properties, as well as on a banner during the recent Children’s Mashramani

A protester outside GRA holds a placard highlighting several grammatical errors which have appeared on Finance and Education Ministries’ properties, as well as on a banner during the recent Children’s Mashramani

On Main Street, at a protest organised by Non-Governmental Organisation (NGO) Red Thread, protesters made it clear that the placement of VAT on these services was inconsistent with the Government’s promise of a good life for all.

According to Joy Marcus, a representative of the NGO, reducing VAT by two per cent and then placing previously exempt items on the tax list is simply an increased burden the average citizen cannot afford.

The protestors outside of the Finance Ministry

The protestors outside of the Finance Ministry

“Every cent that is added is a lot. (It) is adding more burden to us. And we’re saying that we can’t afford it. Government has promised us a good life.”

We’re calling on the Government to reverse the VAT on electricity and water. As it is, poor people already have a burdensome life and we’re struggling to survive as poor people. That good life that was promised, we’re not seeing it, we’re not feeling it and we would really like to enjoy that good life.”

Referencing the circumstances pensioners have found themselves in, Marcus juxtaposed the removal of subsidies pensioners had on water and other utilities, with the increase in pensions to $19,000 monthly.

“You take away the subsidies from pensioners and you increase (it), but how far can that go? When you strip that $19,000 to a day, you get an average of $625. What can that buy?”

“And then look at people on public assistance, who are getting $7500. Think about the low-wage workers. We already have the burden of housing our children, sending them to school; we have to choose between which one we are going to do or which one is more important.”

Separate but united

Meanwhile, students and parents gathered outside GRA at midday. Though separate from the Finance Ministry protesters, they were united in their concerns about VAT. The group called for the removal of the 14 per cent tax on private education and consumer goods and services, previously exempt, which now attract VAT.

Though the turnout was not as big as expected, their united voices were loud. Organiser of the protest, businessman Roshan Khan stated that while expecting a larger crowd, he was not fazed by the comparatively low turnout.

Khan demanded that the Government immediately reverse the VAT charge on education and issue an apology to the country. Other persons on the picket line also had similar cries and called on the Administration to act swiftly to reverse the measures.

“The protest is to save the youths, who may be thinking of migrating. If they want to go to private school – nursery, kindergarten, anything that has to do with private education, (the imposition of VAT) is ludicrous.

“What do they want? Why did they not consult with their people who elected them? Why did they not consult with their own supporters who want to send their children to private school? People send their children to private school not (necessarily) because they are rich. It is unfortunate that the leadership thinks that those people who go to private schools, their families are rich.”

He noted that they chose to assemble despite reports appearing in the public domain and online news outlets on Monday that President David Granger would announce the removal of VAT on education.

According to Khan, the confusion it created may have actually played a role in the reduced turnout of protesters. Nonetheless, the businessman stated that it would be better if the President as someone elected by the people to lead the nation or a government official made this announcement.

John Edghill, a young student, was also present on the protest line. He noted that for him, as a private school student who was working in order to offset the expenses of his studies, the VAT on education was a worrying burden.

“It is an additional burden on me. I don’t make a lot of money. I’m at an entry-level job. I’m helping to pay for my education. Adding 14 per cent will just increase the burden on me. I still have other things to do with money, every day. There is VAT on a whole lot of other (items) now.

“They increased the threshold, and now they’re taking back more of our money. So don’t fool us with this giving and taking back. It is also a bad precedent they are setting. We have so many academics that are not being offered by the University of Guyana that are being offered at these private institutions and you are going to put VAT on these things? This is ludicrous.”

Edghill recalled that the Government had campaigned on a promise of providing a good life, and there were many young people in the private education system who see the measure as a burden.

“You can’t make Guyana great if you are taking away the dreams of young people. I attend Nations and I see a lot of people working and funding their own education. And it is just going to be a burden on them. And a lot of persons are going to drop out. There are people trying to do MBA courses which cost millions of dollars. That’s 14 per cent on that too. It’s just crazy.”

The demonstrators also stated their intention to continue to protest regularly until Government acceded to the widespread opposition to the VAT.

In the 2017 budget, Government had reduced VAT from 16 per cent to 14 per cent. It had also increased the VAT threshold from $10 million to $15 million.

In an unprecedented move, however, the 14 per cent VAT was applied to electricity consumption exceeding $10,000 per month and water consumption exceeding $1500 per month. It also applied to private education fees.

Except for the ones relating to exports and manufacturing, all items which were previously zero-rated were removed from the list.

When he made his presentation last year, Finance Minister Winston Jordan had projected a rise in VAT collection of 1.7 per cent, amounting to $36 billion.

The Opposition People’s Progressive Party (PPP) has, however, long denounced the Government’s method of taxing its way to wealth generation. Chairman of the Public Accounts Committee in Parliament, PPP/Civic Member Irfaan Ali has maintained that the expanded areas of taxation would increase the burden on Guyanese and local businesses.

Ali had observed that in relation to pharmaceutical and medical supplies, the cost of accessing private medical service would increase dramatically. But that’s not all.

He had expressed that private medical staff such as nurses, medics, laboratory technicians and others may face the risk of losing their jobs, since patients would now be forced to seek medical service from public hospitals owing to prohibitive costs.