Guyanese should be worried about rapidly increasing debt – Former Finance Minister Jordan

Nov 17, 2021 -- Source -- Kaieteur News Online -- https://www.kaieteurnewsonline...nce-minister-jordan/

Kaieteur News – Guyana’s midyear report on its financial performance and standing as a country reported its total stock of debt to be some US$3B and according to former Minister of Finance, Winston Jordan, the country’s ballooning debt should be of concern to all Guyanese.

According to Jordan, the administration’s signaled intention to borrow several billions more is based on the assumptions that oil resources will continue to earn at current world market prices at some US$80 per barrel.

Former Finance Minister, Winston Jordan

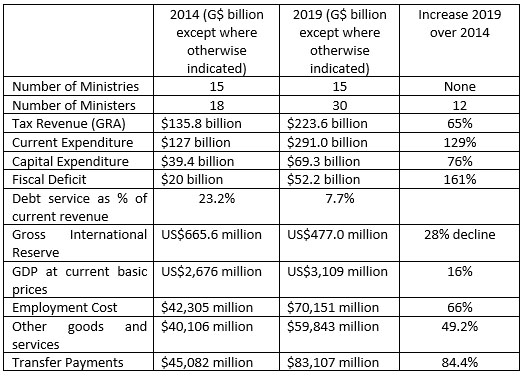

Jordan gave his assertions during a ‘Plain Talk’ discussion with host, Christopher Ram, and in expressing his concerns about the level of debt, coupled with the fact that the administration is keen on taking on more, he drew reference to Ghana.

According to the former finance Minister, the fact that none of the large scale projects have been factored into the equation should be of concern.

Jordan referenced a recent confirmation on the part of Vice President Bharrat Jagdeo, and first reported in another section of the media, that Government was looking to access some US$1.5B in loans from China.

The former Finance Minister noted that at half year, the debt stood at US$2.9B and along with the proposed loan from China, there is also another amount to the tune of some US$1.9B from the Islamic Development bank to be secured.

He drew reference, too, to the fact that only recently, Head of State President Irfaan Ali announced an intention to approach the United Arab Emirate (UAE) to tap into their ‘sovereign wealth fund’ for investments in Guyana.

Additionally, the President had announced an intention to approach the Kuwaitis with an interest in accessing their investment fund.

The former Finance Minister noted, too, that among the external debts being contracted by the administration are several loans that are not being factored into the equation. These include the Gas-to-shore initiative, the Amaila Falls Hydro Electric Project (AFHEP), and the New Demerara River Bridge.

These additional debts, to be contracted according to Jordan, do not even include the regular borrowing from institutions like the World Bank, the Caribbean Development Bank, and the Inter-American Development Bank (IDB), among others.

Jordan used the occasion to recall that the President of the IDB is scheduled to arrive in Guyana shortly.

President Ali told reporters that the duo had met previously to discuss the finalizing of programmes for which Guyana presently has applications.

According to President Ali, he was assured by the IDB head that the priorities of the Guyana Government in fact align with that of the bank.

He, in fact, reported that the IDB is keen on remaining one of Guyana’s primary development partners and reemphasized its commitment to Guyana.

President Ali reported also that the President of the bank himself would be visiting Guyana imminently with a view to getting a fuller understanding of the types of projects identified as critical in Guyana and areas where the bank can provide financing.

The IDB currently has the largest share of Guyana’s external debt according to the government’s mid-year report on the country’s finances.

According to the information contained in the Mid-Year Report for 2021, monies received from the IDB in loans increased 10 fold, from US$5.2 million in the first half of 2020, to about US$55.5 million for the corresponding period in 2021.

The report stated, about 75.2 percent of the latter amount was allocated to combating the economic and social ramifications of the pandemic.

Additionally, this publication last month reported that Guyana had approached the IDB for a loan totalling US$1,817,764 to support the development, and implementation of a Medium-Term Development Strategy, which will leverage on the country’s emerging oil and gas revenues.