The crafty contract and Guyana’s implicit and explicit earnings

By Tarron Khemraj OnIn Business Page |

By now many Guyanese would have heard about the 14.25% effective royalty, which combines the 2% actual royalty enshrined in the contract, the 50-50% profit share and the 75% cost-recovery cap. According to Article 11 of the Petroleum Agreement between the Guyana government and ExxonMobil subsidiaries, the cap on cost recovery is monthly. This means that if monthly unit cost exceeds 75% of market value, the rest is carried forward to the next period.

However, the contract does not specify a cut-off year for recovering the pre-production costs such as exploration, development and pre-contract expenses. Is the cut-off year 2024, 2025 or 2026? These costs will be added to the operating costs once production starts to come up with an overall average or unit cost of production. Students of cost accounting and microeconomics would think of this as an average fixed and variable cost of production. Since the time when these pre-production costs are fully recouped will determine the 50-50% profit share for government, it is surprising the government did not seek clearer language in the contract.

The price of oil is determined on the spot market and it changes each day. However, costs are much less flexible. Labour, transportation and other input costs are set by contract. They are sticky, while price per barrel is flexible. Therefore, it is possible for market price to fall below the overall unit cost, making profit oil negative. Therefore, the 75% cap of cost supposedly preserves a minimum point for Guyana.

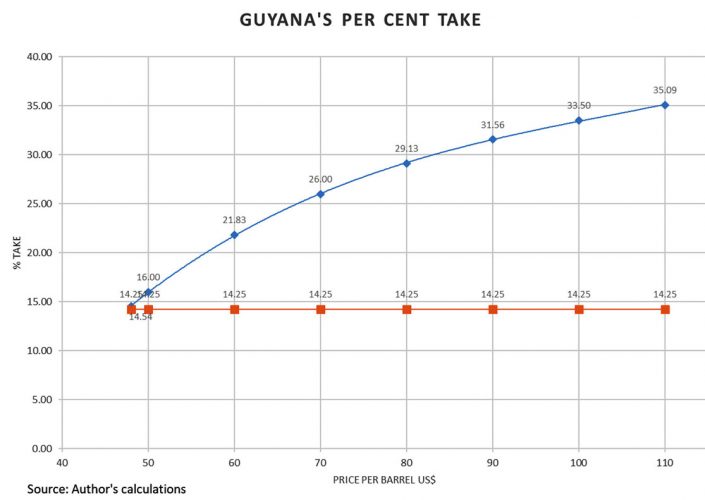

This is important because during the unspecified cost recovery period the minimum that Guyana can receive is supposedly 14.25% of the market price for oil. The IMF report for the Minister of Finance presented one scenario. They assumed a market price of US$100. This means that after accounting for 2% explicit royalty and the 75% cap on cost, the cost oil is US$73.50. If you work this out Guyana gets 14.25% of the US$100 per barrel. This includes the 12.25% implicit royalty plus 2% explicit royalty.

What happens if the price is now is US$50 per barrel and the cost recovery limit is binding or enforced? Taking into account the 2% royalty and the 75% of market price cost cap, cost oil now becomes US$36.75. Again after profit share, this leaves Guyana with 14.25% of the US$50 per barrel. If we keep doing this using the prescribed formula, Guyana is possibly guaranteed 14.25% throughout the production period.

I find it interesting that all the average cost estimates, including the US$20.8 per barrel which the IMF uses in its calculations, are way below the average market price of oil since 2005. This implies that profit oil is most likely to be positive and therefore Guyana is expected to earn an amount in excess of 14.25% even from 2020. In my previous column, I used the unit cost of US$35 per barrel. The unit cost is almost non-binding since 2005. I said almost since only on one occasion West Texas Intermediate oil price breached the US$35 per barrel. This occurred in February 2016 when the price fell to US$32.32.

The chart presented shows that Guyana’s percentage take in any month exceeds the minimum of 14.25% once the market price rises to US$48 per barrel, at which point the country earns 14.54% of the market price. At US$60 per barrel, the earning is 21.83% of market price and at US$70 per barrel the earning is 26%. If the price jumps to US$100 per barrel, Guyana would earn 33.5% of that price. At a price of US$110, the take will be 35.09%.

However, all these percentages have to be discounted by the monthly transport cost and marketing fees since Guyana is being paid in profit oil and not US$. The Guyana government will most likely ask ExxonMobil to purchase and market the oil. Therefore, subtract about two percentage points for transport and marketing fees from each number in the chart to get an approximation of the monthly take for Guyana over various price possibilities.

If the overall average cost including pre-production and operating costs is almost non-binding, why not clearly specify a number of periods for recouping the costs? Why leave the contract open? Since no time period is given for when the cost recovery of pre-production costs ends, we have to assume the contract was written in an open ended manner to allow the extension of cost recovery. How can one conceptualise this mathematically? Consider the following.

The contract opens the door for recurrent cost recovery. Consider the following legal terms of the contract. In any given month cost oil has two parts: (i) the component that is equal to 75% of market price and (ii) a recurring portion (25%) that is passed into the next period. Imagine this process is repeated multiple times (or even a few times), a reasonable assumption given the open ended nature of the contract.

These legal terms give an equation – known to economists as a difference equation – expressing cost in any given month as Cost (t) = 0.75*P (t) + Cost (t – 1). Here t = this month, t – 1 = last month and P (t) = this month’s price per barrel of oil. The elements making up cost oil are outlined in Annex C of the contract. For our purposes we only need to remember that cost oil has a current component [0.75*P (t)] and a recurrent or recursive component [from previous months: Cost (t – 1)].

The general public don’t have to solve a difference equation to appreciate conceptually what they can illuminate when they are solved. The equation above is the unsolved difference equation. It is the equation determining the motion of cost oil in any given month. First, when the equation is solved, it allows for adding all recurring costs over the lifetime of the project. Therefore, we can sum up all the carried forward costs. I would think this is useful information as government considers its monthly revenue forecasts.

Second, the solution tells how long it will take to recoup a given amount of booked recurring cost given a shock to the price of oil. This could also help the authorities figure how long it will take for a unit of recurring cost to be recovered. Note, not because a unit of cost oil is pushed to next month means it is fully recovered next month. The solution of this equation answers this question.

Third, since the coefficient in front of Cost (t – 1) is 1, a unit of carried forward cost oil will permanently increase average cost of the project. In common language, this implies the cost is always booked; hence, suppressing profit oil. Essentially, this is the key insight of the equation.

Fourth, even when average cost is nonbinding, a fixed average cost can be added to the equation to reconsider the previous two points made. We can still calculate that a unit of booked carried forward cost will permanently increase average cost for the project. It should be no surprise why the contract is open ended.

Finally, I believe from a macroeconomic management standpoint, it is important to have the most accurate estimates of average cost and profit oil. My simulations in the figure above assume the average cost is US$35 per barrel. It would be interesting to see what happens when the average is US$20.8.

Comments: tkhemraj@ncf.edu

Copyright © 2017 Stabroek News. All rights reserved.