Oil economy and grassroots budgets

By Red Thread

Red Thread’s members are primarily grassroots women, who live daily with various forms of economic and social insecurity. Despite this, over three decades, we have built an organisation that advocates and organises with women, beginning with grassroots women, to cross divides and transform our conditions. Red Thread runs the Cora Belle and Clotil Walcott Self-Help Drop In Centre, which provides support for and advocates with survivors of domestic violence as well as low wage workers (https://redthreadguyana.org/)

Five days before Christmas, we wrote an article that was published in the Stabroek News, ‘Oil, oil everywhere but not enough to eat: A holiday reality check.’ We wrote it because oil was being celebrated as some big saviour that is going to deliver development up and down the country. It will deliver us from poverty, and make all Guyanese, if not rich, then at least able to enjoy a higher standard of living. The good life for all. This is what is being promised.

But what is our everyday reality? As we pointed out then, a 2020 report by the Inter-American Development Bank noted that 41.2% of Guyanese live on less than US$5.50 per day (just over G$1000.00 a day). A Kaieteur News article published last April noted that the national minimum wage is some G$44,200 (USD$221).

And from just the Liza-1 oil field, every single day ExxonMobil (XOM) makes nearly five times (USD$8,208,000/G$1.77 million) the amount that 41% of Guyanese live on! These are our resources. They belong to the Guyanese people. How can this be fair?

We have continued to collect information on the daily budgets of grassroots women – those who have to stretch a dollar, who have most responsibility for shopping, cooking, caring for families and children.

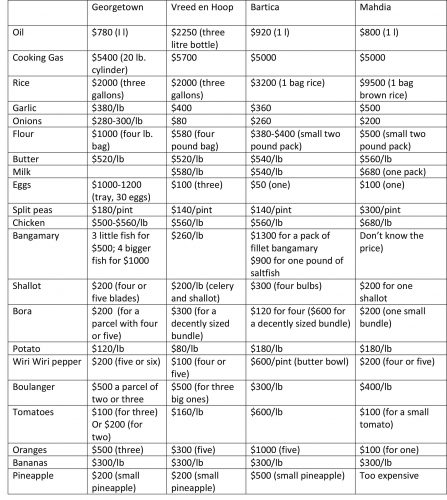

Last week a group of grassroots women came together – two indigenous women, two Indian women, three Black women – from Bartica, Mahdia, Tuschen, Parfait Harmonie, Georgetown, to talk about how much we are spending to feed our families. We present two tables. The first shows prices for some food items and compares those prices across our communities. Although we know the prices for most things, we are not able to actually buy some of these items listed below. For example there is no record of what fish costs in Mahdia because the women we spoke with do not even go to the fish vendor since they can no longer afford to buy fish. Some things we are buying less of. Some things we are no longer able to buy at all so we do without.

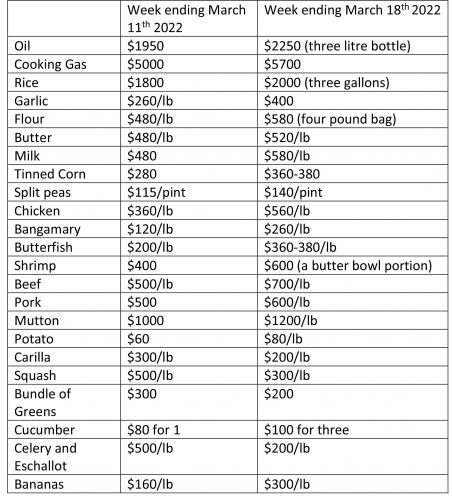

The second table shows the change in prices in Vreed en Hoop in just two weeks. Thankfully the prices for some vegetables went down slightly, but we do not know how long that will last and this is not the case for women in the other communities. Moreover, travelling to Vreed en Hoop to shop (and paying the gas or public fare to get there) is cheaper for some women than trying to shop in their own communities. For example, the same bottle of oil that cost $2250.00 last week in Vreed en Hoop (itself an increase in the price from the previous week), was being sold for nearly $4,000.00 in Parfait Harmonie.

People can talk about what the oil economy will do for us, but at the end of the day, as grassroots women, we are the experts on what the impact is on our daily lives across our various communities. And this is what we are seeing so far.

TABLE ONE: PRICES ACROSS COMMUNITIES, WEEK ENDING MARCH 18, 2022

TABLE TWO: PRICE CHANGES BETWEEN LAST WEEK AND THIS WEEK IN VREED EN HOOP