The Bank of Guyana’s public deposits overdraft position continues to widen, moving from $69.1 billion as of October 23, 2019 to $73.3 billion as of November 13, 2019 – a whopping $4.2 billion movement. This is according to the Bank of Guyana’s statement of assets and liabilities at the close of business on November 13, 2019, which was published in the November 23, 2019 Official Gazette.

According to last month’s report, the deficit further widened by $3.5 billion from September to October 2019 alone. The Bank of Guyana’s statement of assets and liability as of October 23, 2019, the bank’s public deposits were listed at an overdraft of $69.1 billion. In September 2019, the overdraft stood at $65.6 billion.

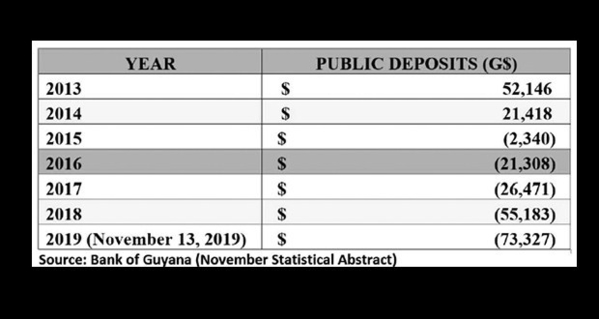

The Public Deposit overdraft has widened by $10.7 billion from January 2019 to October 2019. At the end of January 2019, public deposits were recorded at an overdraft of $53.4 billion. This moving from a positive position of $21.4 billion at the end of 2014. At the end of 2015, the APNU-AFC government ended the year with an overdraft of $2.3 billion, and this continued to worsen over the four-year period.

By 2016, the overdraft had grown to $21.3 billion, due to increasing withdrawals. At the end of the 2017 fiscal year, the overdraft had reached $26.5 billion. By the end of 2018, the overdraft more than doubled to $55.1 billion.