April 4, 2021

The government’s overdraft (negative balance) as at end February 2021 stood at G$139.7 billion. As at end 2020, the number was negative G$135.4 billion. The present government inherited a negative balance of G$92.8 billion in August 2020. One can think about this balance as the level of water in a bathtub. The water level increases in the tub when the inflow from the faucet is greater than the drain at the bottom of the tub. If the leak or outflow is larger than the inflow, the level of the water will fall.

Similarly, the government has its core account at the Bank of Guyana that it uses to make payments to other sectors of the economy, namely households and businesses in the private sector. The government, of course, cannot make payments to foreign nationals from this account since they would not accept the Guyana dollar as settlement. Foreigners will want US$, Euros or some other major world currency. Nevertheless, if there are excessive payments from the said account, there can a steep increase in demand for US$ and other hard currencies, as well as foreign goods. Excessive use of the account would cause scarce hard currencies to exit Guyana.

When the government puts in more money than it spends, the balance will increase like the water level in the tub. The fact that the balance is continually negative means that the inflows into the account are less than the outflows or leakages. The inflows and outflows are connected to the fiscal balance which we will define as revenues (taxation, etc.) minus expenditures (public sector wages and salaries, road construction, maintenance of buildings, financing of prior debt, etc.).

If in a given month a household spends more than its salary and other gains, then the household has a deficit that that must be financed by using previous savings, asking a relative for a cash gift and/or borrowing using credit card. Similarly, a government’s deficit must be financed each year by borrowing, seeking foreign grants, and/or using money from its account at the central bank (the BoG). In general, spending from the BoG account should not exceed the deficit. At least, according to accounting, economic and mathematical logic.

However, we are talking about Guyana where politicians across the divide have assumed control of every aspect of the society. Politics is contentious because of the objective to capture the government. Those who control government are able to steer goodies to agents – foreign and local – who finance election campaigns and to their respective solidified ethnic base. Of course, this patronage flow is not the whole story. The PPP/C government spends enormous amounts of money in communities outside its primary ethnic base in the hope of expanding future votes. On the other hand, the core partner, PNCR, in the APNU + AFC coalition, was not too willing to extend outside its ethnic base, except to a few business people who financed its election campaign. In a few columns, I will back this statement up with mind-blowing data.

There is just one task in today’s column: to point out a connection between the BoG overdraft and the government’s fiscal deficit.

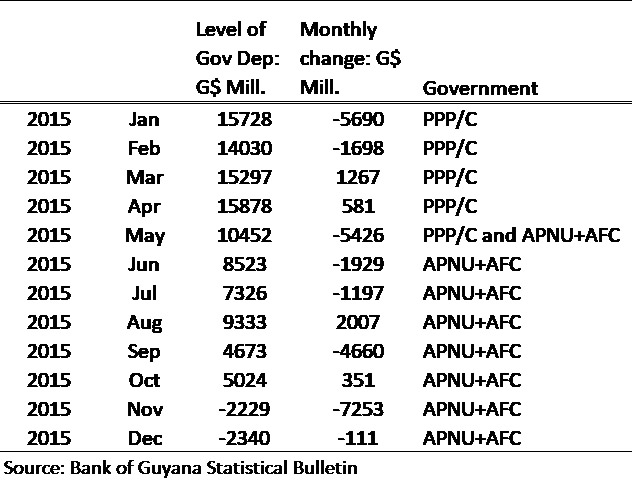

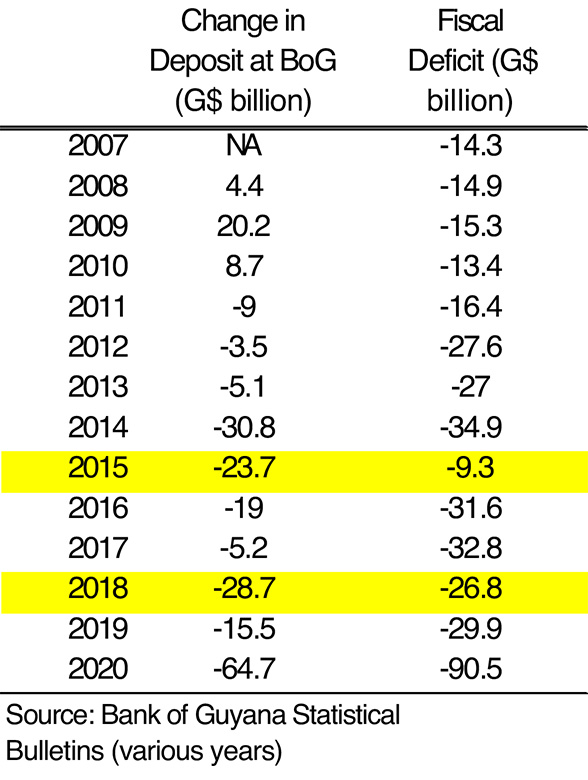

The table at left below presents data from the official accounts that I pieced together. Various observers and myself in the past have shown the stock of money (the water level in the tub) in the account. However, for the purpose of this essay what matters is the change in the amount of money in the account from one year to the next (the flow of water draining out from the tub compared with the inflow).

As can be seen, in the years 2008, 2009 and 2010, the change in the account’s balance was positive, implying that the government was putting in more than it was taking out from the account. However, the change in the balance turned negative since 2011 when the PPP/C was in government. This means that more money was going out than flowing into the account. The year 2011 is pivotal in the post-1992 political economy of Guyana. The PPP/C lost the majority in Parliament but kept the presidency.

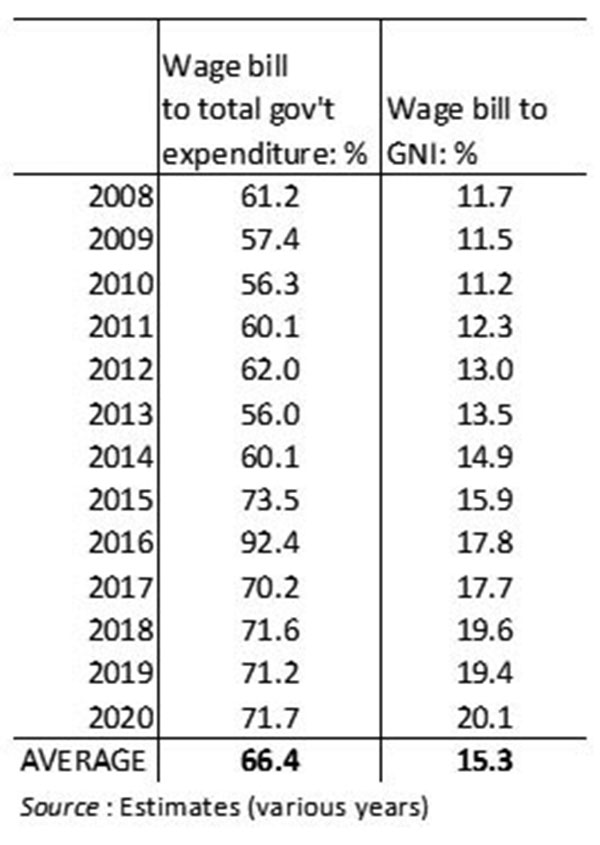

The table shows that the PPP/C cranked up the fiscal deficit from G$16.4 billion 2011 to G$34.9 in 2014. How did the then government finance this? It did so by expanding money creation more than debt sales (T-bills). Money can be created out of thin air when government spends from its account at the BoG, making it the most special bank account in the land. This is what monetary sovereignty means, albeit Guyana’s sovereignty is much narrower compared with say that of Japan or the United States. More of this in my forthcoming academic paper.

Important for our purpose, however, is the sturdy desire to regain the parliamentary majority would result in a significant amount of political patronage in this period. In a future column, I will provide some data to show on what items the PPP/C spent by generating money. In the year just before the 2015 election, the G$34.9 billion fiscal deficit was financed by money creation to the level of G$30.8 billion. This means that 88.3% of the deficit was financed by creating money from thin air.

As can be seen, the year 2015 is very interesting. First, the PPP/C lost government to a historic coalition under APNU + AFC. Second, and more interesting from my viewpoint, the deficit was smaller at $9.3 billion, possibly because of the disruption to the budgeting process. However, the spending did not stop. The government’s account moved into a deeper overdraft by an amount of G$23.7 billion. This is what I meant earlier by a violation of accounting, economic and mathematical logic. Is this a statistical error? Well, it happened again in 2018 under the APNU + AFC government when the overdraft of G$28.7 billion exceeded the fiscal deficit of G$26.8 billion.

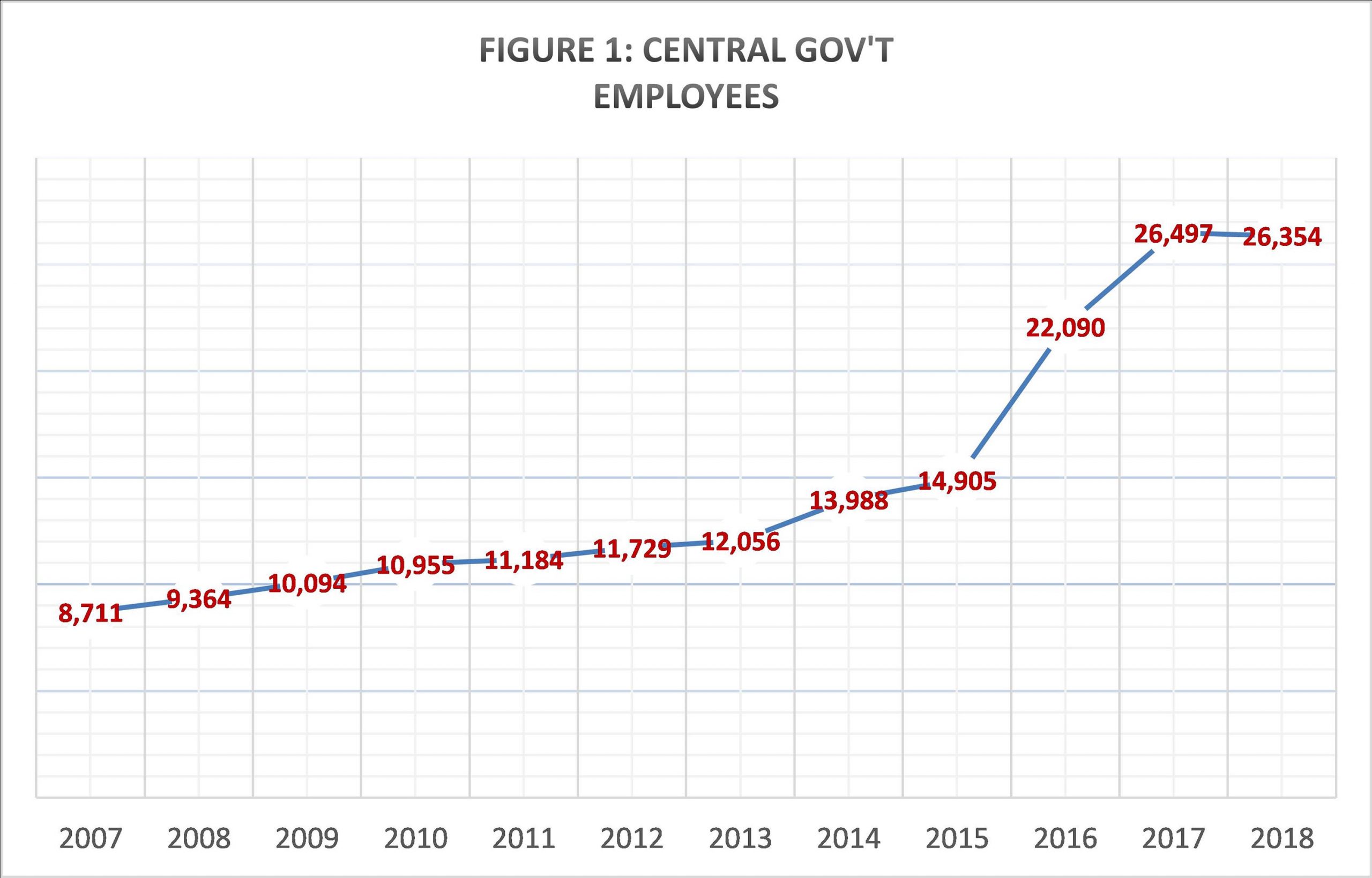

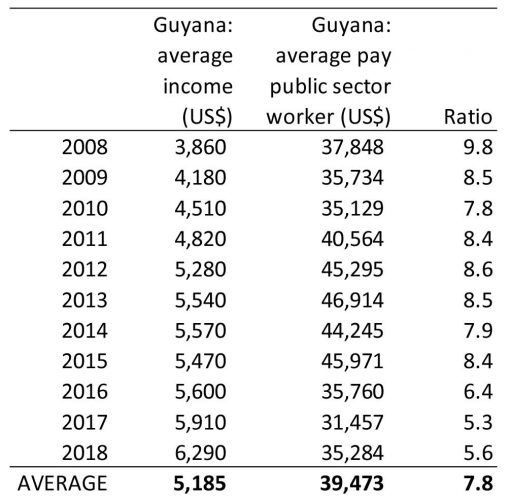

Both 2015 and 2018 suggest that monies were created outside of the budgetary process and extended to political groups. Indeed, there were numerous reports of monies being paid to various groups who were not official employees of the government. Many were PYO, YSM and other party members. There was liberal contract employment under the early PPP/C government, but substantially more under APNU + AFC. Finally, the year 2015 was also interesting because of the Grangerian D’Urban Park fiasco and the possibility that a few elements inside the PPP/C might have received a percentage of these funds as exit patronage.

Imagine how this narrow monetary privilege could be used if there was a more cohesive society. There would be no more homeless people, help with mental health will be available for those who need it, and pensioners would receive good care. However, these funds have disappeared and there is nothing to show, perhaps except a few fancy SUVs (that have to be imported) and homes in poorly drained neighbourhoods with lots of rum shops and noise, but without green places and space for physical activities. In closing, it will take several more essays to fully explore the angles. I hope you will stay tuned.

Comments can be sent to: tkhemraj@ncf.edu