Jan 29,2018.

Dear Editor,

We don’t need to hear about the personal sacrifices of politicians during past political campaigns or the hardships of being a leader, especially when such inflated speech is used as a means to defend the worst contract ever agreed upon, if opportunity losses to Guyana are computed on a per capita basis in the Production Sharing Agreement between Guyana on one side and ExxonMobil, Hess, and CNOOC on the other. What we really heard is a hot air blast of arrogance, verbosity, and self-glorification from one of Guyana’s most skilful communicators.

Simply put, the oil find in Guyana is so huge that even extreme incompetence and mismanagement will not substantially mitigate the spouting flow of wealth and value that will occur in Guyana from 2020 and continue for the long term.

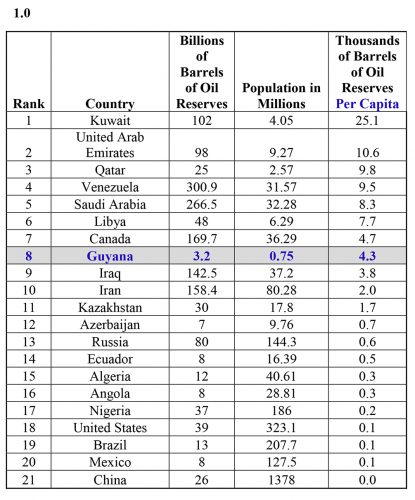

Using the WorldAtlas. com oil data table, dated January 11, 2018, I have modified the rankings, by including Guyana’s oil reserves on a per capita basis, for comparison against the world’s top twenty countries with the largest proven oil reserves:

On January 17, 2018, a Bloomberg article noted: “The world’s hottest offshore prospect for oil companies is off the coast of Guyana, where a string of major discoveries has drawn hundreds of millions of dollars in a quest for crude.

Michael Fitzsimmons in his January 26, 2018 article for Seeking Alpha (a crowd-sourced content service for financial markets); highlighted the following:

Exxon has made six discoveries in the deep-water offshore of Guyana.

Associated recoverable reserves are now up to 3.2 billion Barrels of oil equivalent (BOE).

To put that into perspective, that’s 200,000 Barrels of oil equivalent per day (BOE/D) for 43 years.

Exxon needed a big reserves replacement after de-booking massive oil sands reserves last year. It found them.

It is well known within the oil industry that corporations tend to be conservative on their estimated recoverable oil reserves. In addition, to the foregoing, exploration in Guyana’s offshore is at an early stage and it is much more probable than possible that Guyana’s recoverable oil reserve will exceed the ten billion BOE.

ExxonMobil is the single largest publicly traded oil corporation in the world, with a market cap of just under US$380 billion, and more significantly for Guyana, Exxon Mobil is a quintessential United States corporation, the country that by a substantial gap is the world’s top military superpower.

Yours faithfully,

Nigel Hinds