Sugar estates bids boil down to five

-DDL opts out of Enmore

Following the examination of 10 submissions, only five companies have entered bids for three shuttered sugar estates and a pall was cast over the process yesterday after Demerara Distillers Limited (DDL) announced that it was not pursuing its interest in the Enmore operations.

Very little information was available yesterday on the companies which have entered bids. The low number of bids is in sharp contrast to earlier assessments from government officials that there were scores of interested companies from the region and further afield

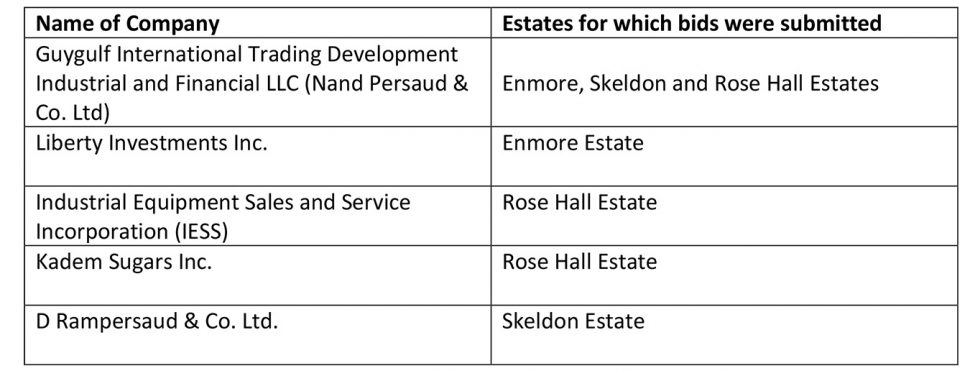

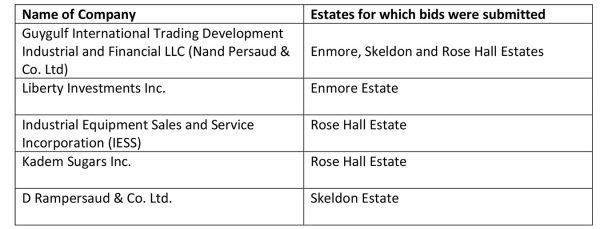

The names of the companies, released by the Special Purpose Unit (SPU) of the National Industrial & Commercial Investments Limited (NICIL), and the respective estates tendered for are shown in the table below…..