Trump is paralyzed!

Obama brought US back from the brink

Trump is paralyzed!

Obama brought US back from the brink

Replies sorted oldest to newest

they should halt trading

What kind of weak ass leader continues to blame others when things go wrong?

Ray posted:What kind of weak ass leader continues to blame others when things go wrong?

An unethical, misogynistic, alleged rapist, racist, dim-witted, immoral one.

he inherited a growing economy....and decided to dismantle everything Obama did...now this

Socialist Rant !! ![]()

![]()

Sean posted:Socialist Rant !!

market lost over a trillion this past week...and you in lala land like your great leader

President Donald Trump’s stock market stacks up well against the majority of his presidential predecessors.

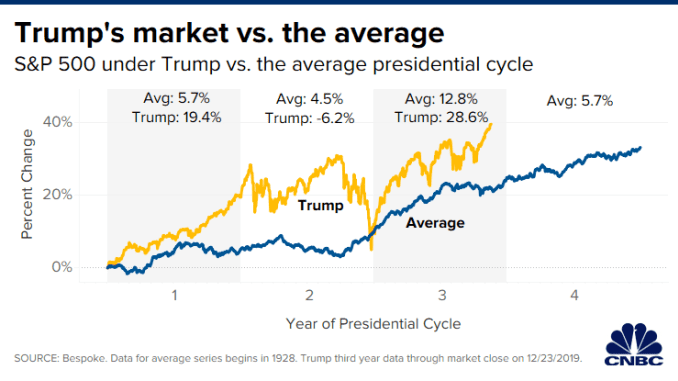

The S&P 500 has returned more than 50% since Trump was elected, more than double the 23% average market return of presidents three years into their term, according to data from Bespoke Investment Group dating to 1928.

The bellwether index gained more than 28% this year, well above the average 12.8% return of year three for past U.S. presidents.

“Year three has been by far the best year of the cycle with an average gain of 12.81%, and the playbook has stuck to the script in year three of the current cycle,” the firm said in a note to clients last month.

Despite the volatility from the U.S.-China trade war, 2019 has been a year of all-time highs for the major stock averages. The S&P 500 crossed 3,200 for the first time ever last week, hitting its seventh round-number milestone of 2019. While business investment slumped due to uncertainty surrounding the world’s two largest economies, public market investors remained confident enough to put money into stocks.

Trump’s market got a boost from Federal Reserve Chair Jerome Powell and the central bank, which lowered interest rates three times this year, the first time since the end of the financial crisis. The Fed slashed rates on fears of slowing growth at home and abroad. Trump was highly critical of Powell for not lowering rates more and faster, often mentioning the near $15 trillion in negative yielding government securities outside the U.S.

Markets were also helped by one of the tightest labor markets in history, with the unemployment rate currently at 3.5%, its lowest since 1969. And since Americans were working, they were also spending. The strong U.S. consumer held the economy up during some reported manufacturing contractions. Consumers also held strong amid a messy bond market, when shorter-term bond yields rose above long-term yields, causing the yield curve to invert, a phenomenon known to precede recessions. The curve has since steepened and is no longer inverted.

Trump’s third year is above average, but not the best of any past president. In 2013, former President Barack Obama’s stock market returned more than 32%, as the economy bounced back from the Great Recession.

Trump’s first year was about triple the presidential average, with the S&P 500 gaining 19.4% compared with the average 5.7%.

Businesses got help from Trump’s 2017 tax overhaul, with companies buying a record number of shares back with the extra money.

The sore spot for Trump’s record was year two. Trump’s market had a below average year in 2018, when the stock market suffered its worst December since the Great Depression amid the intensified U.S.-China trade war and a rate increase from the Federal Reserve. The S&P 500 fell 6.2%, compared with the average gain of 4.5%.

If history is any guide, Trump is in for another strong year in 2020.

Stocks are up in year four more than 66% of the time and the S&P 500 returns an average of 5.7%, according to Bespoke.

Much of these stock gains will depend on how trade talks go with China. Earlier this month, the countries announced a “phase one” trade deal in which China agreed to buy billions in U.S. agricultural products and the U.S. agreed to cancel a round of tariffs. For the most part, stocks shrugged off the deal due to its lack of clarity and uncertain path to phase two.

While Trump is confident about a strong market next year, Wall Street is forecasting much more modest gains. The average S&P 500 target for 2020 among analyst on Wall Street is 3,330, less than 4% higher than Tuesday’s close. Trump will need a 6% gain in the S&P 500 to beat the average presidential return.

—with reporting from CNBC’s Nate Rattner and Michael Bloom.

Say No to Democrat Socialism ![]()

![]()

keep up with the news

Say no to Fake News ![]()

![]()

Stop the socialists from spreading fake news, this ALL about China and Coronavirus:

The current stock market correction gave the market its worst day in years, closing essentially at session lows as the vertical violation showed no signs of pause.

On Thursday, the Dow Jones Industrial Average plunged 4.4%. The S&P 500 index also sank 4.4%, joining the Dow Jones in undercutting its 200-day. The Nasdaq composite tumbled 4.6%.

Apple stock and Microsoft are members of the Dow Jones, S&P 500 and Nasdaq. Amazon stock and Nvidia are S&P 500 and Nasdaq members, while Tesla stock is a Nasdaq big cap.

Travel-related stocks continue to be hammered, but investors are also dumping restaurants, ride-hailing companies and basically anything that involves meeting with groups of people.

Among the best ETFs, the Innovator IBD 50 ETF (FFTY) slid 3.5%. The iShares Expanded Tech-Software Sector ETF (IGV) fell 4.2%, with Microsoft acting as a drag. The VanEck Vectors Semiconductor ETF (SMH) skidded 4.6%, with Nvidia among the notable weights.

Is the stock market correction oversold? After a slew of heavy losses, the major indexes are due for some sort of bounce.

Fear gauges also are at extreme levels. The put-call ratio jumped to 1.21, a recent high. The Cboe Volatility Index spiked to its highest level since February 2018.

Those all point to a stock market rebound, but it doesn't have to happen right away. When there is a bounce, that doesn't mean investors should rush in. Some of the best one-day percentage gains come in stock market corrections or bear markets. Again, the coronavirus complicates the process. A stock market rally attempt could be underway when news breaks of a big new virus outbreak.

Investors might be tempted to jump back in after an encouraging intraday S&P 500 gain or rising Dow Jones futures. It may be best to wait for a follow-through day to confirm a new stock market rally.

In the meantime, investors should try to stay engaged, by building and updating watch lists. The big gains come in the first few weeks after a stock market correction.

President Donald Trump and Larry Kudlow, the Director of Trump’s National Economic Council, aren’t doctors, but they play them on TV. As the coronavirus epidemic spirals into a pandemic, causing a plunge in the U.S. stock market, Trump and Kudlow, a former CNBC TV host, are cynically spreading disinformation about the contagion.

“We have contained this. I won’t say airtight, but it’s pretty close to airtight,” Larry Kudlow told CNBC Tuesday. Also on Tuesday, Trump Tweeted, “Low Ratings Fake News MSDNC (Comcast) & @CNN are doing everything possible to make the Caronavirus (sic) look as bad as possible, including panicking markets…USA in great shape!”

These statements directly contradicted a dire warning issued earlier that day by Dr. Nancy Messonnier, Director of the National Center for Immunization and Respiratory Diseases. She said on a press call, “The global novel coronavirus situation is rapidly evolving and expanding…[meeting] two of the criteria of a pandemic. The world moves closer towards meeting the third criteria: worldwide spread of the new virus.”

Referring to an outbreak in the U.S., Dr. Messonnier said, “It’s not so much a question of if this will happen anymore but rather …exactly when this will happen and how many people in this country will have severe illness.”

If COVID 19 breaks out in America, perhaps you all will give Trump a break. Being consumed with your survival, you would hope he has a solution for the misery. If the virus should exceed then it is the time for less focus on Trump and be bothered about living. America has become a place where every anti-American sentiment is germinated. Genghis Khan to the Persians,"you must have sinned terribly for god to send me as your punishment." With that said, he severed heads by the thousands. The Chinese been responsible for several outbreaks of diseases for several years now.

This one looks like the mother of dem all.

Access to this requires a premium membership.