Was this a backdoor deal?

Jan 26, 2018 , https://www.kaieteurnewsonline...his-a-backdoor-deal/

Reading the tax concessions granted to Exxon Mobil will bring tears to your eyes. It is an indictment against an administration that railed against the previous government, and in total opposition to what it indicated when it got into office.

One of the first things that the government did was to cap benefits paid to the former President, indicating that it did not agree to uncapped benefits. It also expressed concern about the uncapped concessions granted to companies.

Yet, it is the same government which has handed Exxon Mobil tax concessions that are deductible from government’s share of profit oil.

This effectively shortchanges workers who should be benefitting from the taxes to be paid by Exxon.

The government was expected to have driven a stronger bargain when it came to taxes. It was not expected to be that generous.

The Minister of Finance announced that upon assuming office, he found a tax system that was so characterized by high rates that it led to innumerable requests for tax exemptions and concessions. The value of those concessions alone totaled $55 billion, in 2014. (See Kaieteur News article captioned “GRA must tighten up on monitoring of concessions”, of January 10, 2016.

According to the Minister, “In short, the system is broken and we must fix it in a comprehensive manner – one that results in a transparent and predictable tax system that rewards effort, promotes investment, improves our national competitiveness, and removes distortions between and across sectors.”

In wrapping up the Budget debates in 2017, the Minister of Finance is quoted as saying that “I want a tax code that is uniformed and uniformly applied.” The granting of waivers and concessions were said to have weakened the tax system.

Against this background of concerns over the volume and value of tax concessions and waivers granted to companies, and in the context of the expressed desire to see a more uniformly applied tax code, it was expected that the government would have taken urgent steps to cap open-ended concessions to companies.

The contract signed between Exxon and the government, however, nails any such intentions. The tax concessions granted to Exxon are not only open-ended but they are a public scandal.

The agreement provides that except in certain specified instances, no tax, value-added tax, excise tax, duties and fees shall be levied against Exxon with respect to income derived from its petroleum operations or with respect to any property held or transactions undertaken. This proviso effectively hands Exxon a tax holiday in relation to its petroleum operations.

Article 15.2, however, subjects Exxon to comply with the income tax laws. It obligates the company to file returns, assessment of taxes and to keep and show books and records.

The “killer” proviso is, however, Article 15.4. Under this proviso, the Minister, meaning the Minister of Natural Resources, agrees that a sum equivalent to the tax assessed will be paid to the GRA on behalf of Exxon and that the amount of such sum would be considered as income to the contractor. In other words, instead of Exxon paying income tax, the Guyanese taxpayers will have to foot this amount out of profit oil.

How can any government have approved such a concession? Would it not have been better to have gone to the National Assembly and announced that Exxon would not be paying a blind cent in taxes?

We are subjecting Exxon to the income tax laws of Guyana. We are compelling them to file returns and assessments. Yet, it is the taxpayers of Guyana who will have to pay these taxes from government’s share of profit oil. In other words, instead of this portion coming to taxpayers, it will be written off against the company’s tax liabilities.

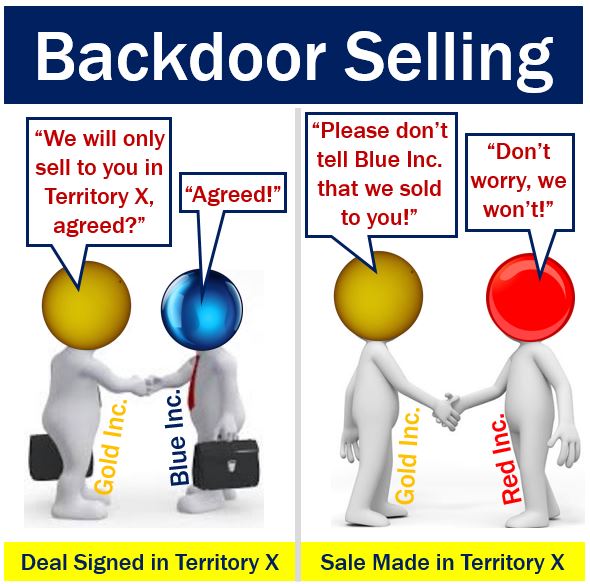

It is incomprehensible that the present Cabinet could have approved such an agreement. It is time for someone to level with the Guyanese people and confirm what is suspected: this agreement did not have the blessings of the full Cabinet. It was a backdoor deal. Was it?