A MISCARRIAGE OF JUSTICE - (Part 2)

Written by HARRY GILL

Monday, 19 August I Guyana Chronicle

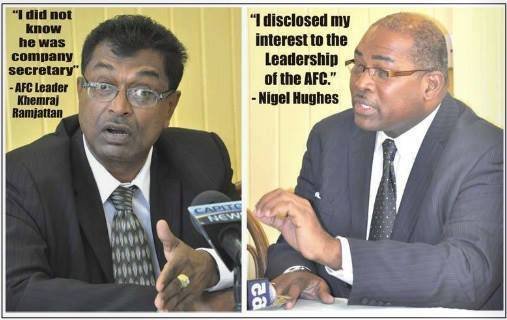

IN Part 1 of my letter (published in the Chronicle on Sunday Aug 18), I wrote about the unethical behaviour of Nigel Hughes as it relates to the Lusignan massacre trial. I will now focus on how he manages his affairs as a delinquent tax- payer. In 2012, The Guyana Revenue Authority(GRA), obtained two judgements against Harvest Company Ltd., a company owned by Nigel Hughes. According to the details of the judgements:

* On October 7, 2011 (Action No. 814/CD 2011) judgement was granted for the sum of $621,967 (being PAYE principal in the sum of $468,183, penalties in the sum of $106,814 and interest in the sum of $46,970) for the periods January - August 2010.

* On June 24, 2009 (Action No. 105/CD 2009) judgement was granted for the sum of $7,236,032 (being PAYE principal in the sum of $2,337,110.00, penalties in the sum of $2,692,231 and interest in the sum of $2,206,691) for the periods August 2005 - December 2005, July 2006 - December 2006 and January 2007 - December 2007.

* On January 7, 2010 Section 44 Certificate was filed for the sum of $1,439,644 (being VAT in the sum of $942,803 and interest thereon in the sum of $496,841) for the periods April 2007 - July 2007 and December 2007; January - June, September and November 2008; January 2009, February 2009 and April - July 2009.

* On October 13, 2011, a Writ of Summons was filed in the High Court to recover $4,429,450 (being PAYE in the sum of $1,230,727 and interest and penalties thereon in the sum of $3,198,723) for the periods January - December 2008 and July - December 2009.

As a result of failing to make payments toward his liabilities, a Writ of Execution was filed on May 22, 2012 to recover Hughes’s indebtedness to the state treasury which totalled over $13.7 million. This is the same man who has been pontificating that the administration is misusing state funds for their own aggrandizement, and using taxpayers’ monies irresponsibly. By not paying his taxes, Hughes is making sure that his money is not among the lot.

But Harvest Company Ltd is not the only company owned by Nigel Hughes that has not been paying the GRA taxes due. Hughes is company secretary for 12 local companies/businesses, and is director of five others. Eight of his companies are delinquent with their registration, which is an indication that those businesses have defaulted on their taxes.

Among those is the Sidewalk CafÉ which still operates, and is therefore in contravention of the Companies Act and GRA’s tax laws. Other delinquent businesses associated with Nigel Hughes are: Kwazimoto Fashions; Kwazimoto Art Work; Hadfield Foundation; CN Lumber Sales (registered under Hughes and Lloyd London); Jazz Works; Sidewalk CafÉ & Jazz Club; and Gini Global Services (Guyana) Inc, of which Hughes is both director and company secretary. Ethical questions are also being raised as to how Nigel Hughes gained possession of the Ariantze Hotel, but I would leave this for “Dem Boys” to investigate.

The underlying aim of the Legal Practitioners (Amendment) Act of 2010 makes it very clear that a lawyer should at all times conduct him/herself in a manner that promotes public confidence in the integrity and efficiency of the legal system and profession: “Honesty, honour and reliability are the fountainheads of integrity.” This Act also rules that: “Neither in his private nor in his professional activities shall there be dishonest conduct on the part of the attorney-at-law.”

Withholding taxes from the GRA adversely impacts the credibility and integrity of Attorney Nigel Hughes.

There is no doubt in my mind that the unethical behaviour of this attorney defies the Code of Conduct set out in the Legal Practitioners (Amendment) Act 2010. Referring to the recent disclosure that he is the company secretary for Amaila Hydro Inc, Nigel Hughes said, “I acknowledge there was a conflict of interest and I assume full responsibility for it.” (Kaieteur News, August 13). Here is what the Act says about Conflict of Interest: An attorney-at-law shall not devise or represent more than one interest in a matter, nor shall he act or continue to act in a matter where there is, or is likely to be a conflicting interest; which includes but is not limited to the financial interest of attorney-at-law or his associate and the duties and the loyalties of the attorney-at-law to any other client or prospective client, including the obligation to communicate information.

Nigel Hughes also clearly did not discharge his duty to the court of law and to his professional colleagues with integrity, when he remained silent as juror Vernon Griffith lied to Justice Navindra Singh to cover up a six-year-old client/attorney relationship he had with him. Had this trial been held in the United States, Hughes may have suffered the same fate of Roger Khan’s attorney, Robert Simmels, who was sentenced to 14 years behind bars and fined US$225,000 for witness-tampering.

As such, I call upon the attorney general; the director of public prosecutions; the chancellor of the judiciary and the Guyana Bar Association to recognise that Nigel Hughes has breached the rules of conduct as explicitly written in the Legal Practitioners (Amendment) Act 2010, and urge that he be given a reprimand and suspended from practice in order to restore public confidence in the judicial system.